Utilizing a standardized form offers several advantages. It ensures consistency and completeness in proposals, facilitating efficient review and comparison across competing requests. A well-designed form also promotes transparency by clearly outlining the financial implications of each proposed investment. This contributes to informed decision-making and better allocation of resources. Finally, it streamlines the approval process, reducing delays and ensuring timely acquisition of necessary assets.

Understanding the components and purpose of such a structured approach is essential for effective financial planning and resource allocation. This discussion will explore the key elements often included in these documents, best practices for their completion, and the role they play in the broader context of capital budgeting.

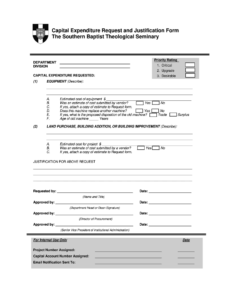

Key Components of a Capital Expenditure Proposal

Effective capital expenditure proposals require specific information to justify the investment and facilitate informed decision-making. The following components are typically considered essential:

1. Project Title and Description: A concise, descriptive title and a brief overview of the proposed investment are necessary to provide context and clarify the purpose of the request.

2. Justification and Strategic Alignment: This section explains the business need driving the request and how the investment aligns with overall organizational goals and strategic objectives.

3. Cost Breakdown: A detailed breakdown of all anticipated costs, including initial investment, installation, training, and ongoing maintenance, should be provided. Supporting documentation, such as vendor quotes, may be required.

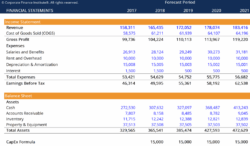

4. Projected Return on Investment (ROI): A financial analysis demonstrating the expected return on investment, including metrics such as net present value (NPV) and internal rate of return (IRR), is crucial for evaluating the financial viability of the project.

5. Risk Assessment: Potential risks associated with the investment, along with mitigation strategies, should be identified and assessed. This ensures that decision-makers are aware of potential challenges and have plans in place to address them.

6. Implementation Timeline: A clear timeline outlining key milestones and expected completion dates for the project provides a framework for tracking progress and ensuring timely implementation.

7. Alternatives Considered: Presenting alternative solutions that were considered, along with an explanation of why the proposed investment is the preferred option, demonstrates thorough analysis and sound judgment.

8. Supporting Documentation: Relevant documentation, such as vendor proposals, market research, or technical specifications, strengthens the proposal and provides further justification for the requested investment.

Thorough completion of these elements allows for a comprehensive understanding of the proposed investment, enabling effective evaluation and prioritization within the context of available resources and competing priorities.

How to Create a Capital Budget Request Template

Developing a standardized template for capital budget requests ensures consistency, facilitates efficient review processes, and promotes informed decision-making. The following steps outline a structured approach to template creation.

1. Define Scope and Objectives: Clearly define the purpose of the template and the types of capital expenditures it will cover. Consider the organization’s specific needs and industry requirements.

2. Determine Required Information: Identify the essential information needed to evaluate requests effectively. This typically includes project details, justification, cost analysis, projected returns, risk assessment, and timelines.

3. Design the Template Structure: Create a logical structure for the template, organizing information into clear sections and using headings and subheadings for easy navigation.

4. Develop Input Fields and Instructions: Design input fields for each required data point. Include clear and concise instructions to guide users on how to complete each section accurately.

5. Incorporate Financial Metrics: Integrate relevant financial metrics, such as ROI, NPV, and IRR, to facilitate financial analysis and comparison of proposed investments.

6. Include Approval Workflow: Incorporate a section for approvals and signatures, outlining the necessary steps and individuals involved in the authorization process.

7. Test and Refine: Pilot test the template with a small group of users to identify any areas for improvement. Gather feedback and refine the template based on user experience.

8. Implement and Train: Once finalized, implement the template organization-wide and provide training to ensure consistent usage and understanding.

A well-designed template provides a structured framework for requesting and evaluating capital expenditures, leading to improved resource allocation and better investment decisions. Regular review and updates ensure the template remains aligned with evolving organizational needs and best practices.

Standardized forms for requesting capital expenditures provide a crucial framework for organizations to effectively manage investment proposals. These structured documents facilitate consistent and transparent evaluation of requests, ensuring that decisions are based on comprehensive financial analysis, strategic alignment, and risk assessment. Utilizing a well-designed template streamlines the approval process, improves resource allocation, and ultimately contributes to better investment outcomes.

Effective capital budgeting requires a disciplined approach. Organizations that prioritize the development and implementation of robust processes, including standardized request templates, are better positioned to make informed investment decisions that drive growth and enhance long-term value creation.