Utilizing a formal, consistent structure streamlines the approval process for substantial purchases. It promotes transparency and accountability by providing decision-makers with the necessary information to evaluate the request effectively. This standardized approach can also simplify budgeting and forecasting by providing a clear record of anticipated capital expenditures. Ultimately, it contributes to more informed and strategic resource allocation.

This article will further explore the key components of these valuable documents, offer practical guidance on their creation and implementation, and discuss best practices for maximizing their effectiveness within an organization.

Key Components of a Capital Expenditure Request

Effective requests for significant investments require detailed information presented in a clear and organized manner. The following components ensure that decision-makers have the necessary context to evaluate the proposed expenditure.

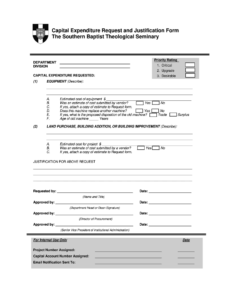

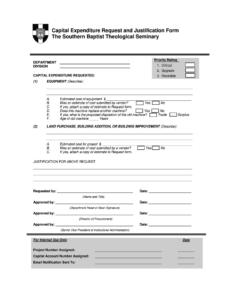

1. Requestor Information: This section identifies the individual or department initiating the request, including relevant contact information.

2. Date of Request: Provides a timestamp for the request, facilitating tracking and processing.

3. Description of Asset: A detailed explanation of the item or system being requested, specifying its purpose and functionality. Including model numbers, specifications, and vendor information adds clarity.

4. Justification: This crucial element outlines the business need driving the request. It should explain how the acquisition will benefit the organization, addressing potential improvements in efficiency, productivity, or revenue generation. Quantifiable data and metrics should be included whenever possible.

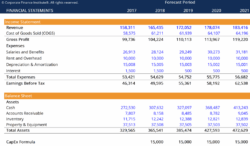

5. Cost Analysis: A comprehensive breakdown of all associated costs, including the purchase price, installation fees, maintenance expenses, and any ongoing operational costs. Presenting different vendor quotes or lease options allows for informed comparisons.

6. Funding Source: Identifies the budget or account from which the expenditure will be drawn.

7. Return on Investment (ROI) Analysis: When applicable, demonstrating the potential financial return of the investment strengthens the justification. This section should quantify the expected benefits, demonstrating how the asset will contribute to the organization’s bottom line.

8. Approval Signatures: Designated spaces for relevant stakeholders to authorize the request, ensuring proper governance and accountability.

A comprehensive, well-structured request facilitates informed decision-making and contributes to the strategic allocation of resources. By incorporating these key elements, organizations can streamline the approval process and maximize the effectiveness of their capital investments.

How to Create a Capital Expenditure Request Template

Developing a standardized template ensures consistency and efficiency in the request process. A well-designed template provides a clear framework for submitting requests, facilitating informed decision-making.

1. Determine Required Information: Begin by identifying the essential data points needed for thorough evaluation. Consider organizational-specific requirements, such as departmental approvals or budget codes.

2. Select a Format: Choose a format conducive to clear presentation and efficient completion. Spreadsheet software or dedicated forms within enterprise resource planning systems are common choices.

3. Design the Layout: Organize the template logically, grouping related information for easy review. Clear headings and concise labels improve readability and comprehension.

4. Incorporate Instructions: Provide clear guidance on completing each section. Include examples or explanations to minimize ambiguity and ensure accurate data entry.

5. Establish a Review Process: Define the approval workflow, specifying the individuals or committees responsible for reviewing and authorizing requests. Incorporate designated signature lines within the template.

6. Implement and Train: Introduce the template organization-wide, providing training on its use and purpose. Clear communication ensures consistent application and maximizes the template’s effectiveness.

7. Regularly Review and Update: Periodically review the template’s effectiveness and make necessary adjustments. This ensures the template remains relevant and aligned with evolving organizational needs.

A well-defined, consistently applied template promotes transparency, streamlines approvals, and supports informed resource allocation decisions. Regular review and adaptation ensure its ongoing effectiveness within the organization.

Standardized forms for requesting significant investments are essential tools for effective resource allocation within organizations. They provide a structured framework for justifying and documenting these substantial purchases, ensuring alignment with budgetary constraints and strategic objectives. Key components such as detailed descriptions, cost analyses, and return on investment projections empower informed decision-making. A well-designed, consistently applied template promotes transparency, streamlines approvals, and facilitates efficient processing.

Effective management of capital expenditures is crucial for organizational growth and sustainability. By implementing robust processes and utilizing standardized templates, organizations can optimize resource allocation, improve financial control, and enhance their ability to achieve strategic goals. Continuous refinement of these processes and a commitment to best practices will contribute to long-term financial health and operational efficiency.