Utilizing a structured format provides clarity and reduces ambiguity, minimizing the risk of miscommunication or misplaced funds. This improved efficiency benefits both requesters and those processing the requests. Clear documentation also aids in tracking transactions and simplifies auditing procedures.

This foundational understanding of structured fund transfer requests allows for a deeper exploration of related topics, such as the specific data elements required, various implementation methods, security considerations, and best practices for effective utilization.

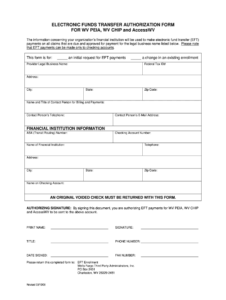

Key Components of a Funds Transfer Request

Effective transfer requests require specific information to ensure accurate and timely processing. The following components are essential:

1. Requester Information: This includes the full name, department, and contact details of the individual initiating the transfer.

2. Recipient Information: The recipient’s full name, account number, bank name, and branch details are crucial for correct routing.

3. Transfer Amount: The precise amount to be transferred must be clearly stated, often in both numerical and written formats.

4. Transfer Date: The requested date for the transfer should be specified.

5. Payment Purpose: A brief explanation of the reason for the transfer provides context and supports auditing procedures.

6. Authorization: Signatures or other forms of approval from authorized personnel are typically required to validate the request.

7. Supporting Documentation: Depending on the nature of the transfer, invoices, contracts, or other relevant documents might be necessary.

Complete and accurate information ensures efficient processing, reduces errors, and maintains a clear audit trail. This facilitates timely fund transfers and strengthens financial controls.

How to Create a Funds Transfer Request Form

Creating a standardized form for requesting funds transfers promotes clarity, accuracy, and efficiency. A well-designed form ensures all necessary information is captured, streamlining processing and minimizing potential errors.

1: Define Purpose: Clearly outline the specific types of transfers the form will accommodate (e.g., internal transfers, vendor payments). This determines the necessary data fields.

2: Gather Required Information: List all essential data points for processing requests, including requester and recipient details, transfer amount, date, purpose, and authorization.

3: Design Form Layout: Create a clear and logical layout using distinct sections for each data category. Ensure sufficient space for entries and consider using tables or other formatting elements for clarity.

4: Incorporate Instructions: Provide concise instructions for completing the form, specifying required formats or any supporting documentation needed.

5: Implement Authorization Procedures: Define clear authorization protocols, specifying required signatures or approvals based on transfer type and amount.

6: Test and Refine: Pilot test the form with relevant stakeholders to identify any areas for improvement or clarification. Revise the form based on feedback received.

7: Disseminate and Train: Distribute the finalized form to relevant personnel and provide training on its proper completion and submission procedures.

8: Regularly Review: Periodically review the form to ensure its continued effectiveness and alignment with evolving organizational needs and regulatory requirements.

A well-designed, regularly reviewed process for requesting fund transfers enhances financial control, reduces processing time, and minimizes the risk of errors. Standardization through formalized requests contributes significantly to a more efficient and transparent financial environment.

Standardized forms for requesting funds transfers provide a crucial framework for accurate, efficient, and transparent financial operations. These structured templates ensure completeness and consistency in requests, minimizing errors, streamlining processing, and facilitating clear audit trails. Key components such as requester and recipient details, transfer amounts, dates, purpose, and authorization are essential for effective processing. Well-defined procedures for form creation, implementation, and review contribute significantly to robust financial controls and efficient resource allocation.

Effective management of fund transfers is paramount for organizational financial health. Adopting and refining standardized processes through structured request templates strengthens financial controls, enhances operational efficiency, and supports responsible resource management. This proactive approach mitigates risks, improves transparency, and contributes to a more secure and sustainable financial future.