Utilizing a standardized form for fund transfers offers several advantages. It improves financial control and transparency, allowing for better budget management and auditing. The streamlined process saves time and reduces administrative overhead, freeing up resources for other tasks. Furthermore, a clear and consistent process minimizes the risk of miscommunication and delays, ensuring projects and operations proceed smoothly.

This structured approach to internal fund transfers is a key element of effective financial management. Further exploration of related topics like expense reporting, budget allocation, and financial compliance within large organizations can provide valuable insights into best practices.

Key Components of a Cash Transfer Request Form

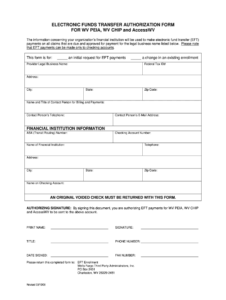

Effective management of internal fund transfers requires a structured approach. A well-designed request form ensures clarity, accuracy, and efficiency. The following components are typically essential:

1: Requestor Information: This section identifies the individual or department initiating the transfer. It typically includes the requestor’s name, department, employee ID, and contact information.

2: Transfer Date: The date the transfer is requested is crucial for tracking and processing.

3: Amount: The precise amount of funds to be transferred must be clearly stated, usually with the required currency specified.

4: Purpose of Transfer: A detailed explanation of the reason for the transfer is necessary for proper accounting and budget management. This might include project codes, vendor details, or internal account allocation.

5: Source Account: The account from which the funds will be debited must be clearly identified. This usually involves account names and numbers.

6: Destination Account: The account to which the funds will be credited must be specified, including account names and numbers.

7: Supporting Documentation: Any relevant invoices, contracts, or other supporting documentation may be required to justify the transfer.

8: Authorization: Signatures or approvals from authorized personnel are essential for ensuring proper control and compliance. This section might include multiple levels of authorization depending on the amount and purpose of the transfer.

Accurate and complete information within these components ensures efficient processing, clear record-keeping, and adherence to internal financial controls.

How to Create a Cash Transfer Request Template

Creating a standardized template for cash transfer requests promotes financial transparency and efficiency. A well-designed template ensures consistency and reduces errors in processing fund transfers. The following steps outline the process of creating such a template.

1: Define Required Information: Determine the essential data points needed for processing requests. This typically includes requestor details, transfer date, amount, purpose, source and destination accounts, supporting documentation, and authorization levels.

2: Structure the Template: Organize the required information into a clear and logical format. Consider using a table format for easy readability and data entry.

3: Incorporate Clear Instructions: Provide concise instructions for completing each section of the template. Specify required formats for dates, account numbers, and other crucial information.

4: Establish Authorization Levels: Define the required approval levels based on the transfer amount and purpose. Clearly indicate where signatures or digital approvals are required.

5: Choose a Suitable Format: Select a format that allows for easy completion, storage, and retrieval. Digital formats like spreadsheets or dedicated software offer advantages in terms of data management and automation.

6: Implement and Train: Introduce the template to relevant personnel and provide training on its proper use. Ensure all stakeholders understand the importance of accurate and complete information.

7: Review and Update: Regularly review the template’s effectiveness and update it as needed to reflect changes in processes or regulations.

A well-structured template facilitates accurate and efficient processing of cash transfer requests, contributing to sound financial management.

Standardized procedures for requesting internal fund transfers, facilitated by a dedicated template such as one potentially used within Publicis Groupe, are crucial for maintaining financial control, transparency, and efficiency. A well-designed template ensures accurate completion of requests, streamlines processing, and reduces the risk of errors and delays. This, in turn, supports effective budget management, strengthens compliance, and facilitates smoother operations. The key elements of such a templateclear instructions, structured data fields, and established authorization protocolscontribute significantly to robust financial governance.

Effective financial management relies on meticulous attention to detail and streamlined processes. Implementing and consistently using a standardized cash transfer request template, and continually refining it based on organizational needs, contributes to a more robust and transparent financial ecosystem. This meticulous approach to internal fund transfers reflects a commitment to financial best practices and efficient resource allocation, ultimately supporting organizational success.