Navigating your personal finances can often feel like a complex maze, especially when unexpected expenses pop up or you find yourself wondering where all your money went. It’s a common scenario for many of us to have good intentions about saving and managing money, but the actual execution often proves challenging. We all want to feel in control of our financial future, moving past the guesswork and into a clear understanding of our income and expenses.

The good news is that achieving this clarity doesn’t require a finance degree or complicated software. Sometimes, all it takes is a straightforward approach to track your money more closely. This is where a simple yet powerful tool, a day to day budget template, can become your best friend. It helps you see exactly where every dollar goes, transforming abstract financial goals into concrete daily actions.

By focusing on your daily spending, you gain a much more immediate and actionable insight into your financial habits. This isn’t about restricting yourself entirely, but rather about bringing awareness to your financial flow, empowering you to make informed decisions that align with your broader financial aspirations, whether that’s saving for a down payment, a vacation, or simply building a healthier emergency fund.

Unlocking Financial Clarity with a Daily Budget

Many people approach budgeting with a monthly mindset, which is a great start, but sometimes the gap between paychecks can feel vast, making it hard to remember where every little coffee or quick lunch fits into the bigger picture. A day to day budget template provides a microscope rather than a telescope, letting you zoom in on your real-time spending and income. This granular view can be incredibly eye-opening, revealing small habits that accumulate into significant amounts over time.

Think about it: a small, seemingly insignificant purchase made daily can add up to a substantial sum by the end of the month. Without a daily breakdown, these ‘leakages’ often go unnoticed. A daily budget forces you to acknowledge each financial transaction as it happens, fostering a heightened sense of responsibility and awareness. It helps you catch those tiny expenditures before they become a bigger problem, giving you the power to adjust course mid-month, not just at the end.

This approach isn’t about being overly strict or denying yourself pleasures. Instead, it’s about informed decision-making. If you know exactly how much you have available for variable spending each day after your fixed expenses are accounted for, you can make conscious choices. Maybe today you skip the expensive takeout because you know you want to save that money for a weekend activity. It’s about balance and conscious allocation.

A key benefit of a day to day budget template is its ability to highlight spending patterns. You might discover that most of your discretionary income goes towards impulse buys, or that you consistently overspend on a particular category. Once these patterns are visible, you can address them directly, rather than feeling like your money just disappears without a trace.

Essential Elements for Your Daily Financial Snapshot

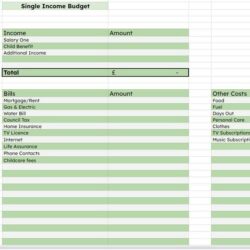

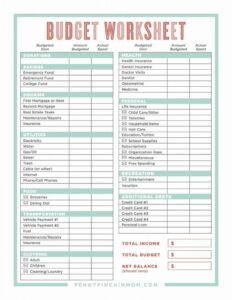

- Daily Income: For freelancers or those with variable income, this could be an average, or specific daily earnings. For salaried individuals, it’s a portion of your monthly income.

- Fixed Daily Expenses: Rent/mortgage, subscriptions, loan payments broken down to a daily amount.

- Variable Daily Expenses: Groceries, dining out, entertainment, transportation, personal care, and other fluctuating costs. This is where the real-time tracking comes in.

- Savings Allocation: A daily amount you aim to put aside for specific goals or an emergency fund.

Setting Up Your Personalized Daily Budget

Creating your own day to day budget template doesn’t have to be complicated or intimidating. The beauty of it lies in its adaptability. You can start with something as simple as a notebook and a pen, a basic spreadsheet program, or even a dedicated budgeting app. The most important thing is to choose a method that you’ll actually stick with and find easy to update regularly, ideally every single day.

Begin by understanding your average daily income. If you have a steady salary, divide your monthly take-home pay by the number of days in the month. For those with variable income, it might be more effective to estimate a conservative daily average or track income as it comes in. Next, identify all your fixed monthly expenses like rent, utilities, loan payments, and subscriptions. Divide each of these by the number of days in the month to get a daily allocation.

What’s left is your daily discretionary income – the money you have available for everything else, like food, entertainment, and personal spending. This is where the day to day budget template truly shines. By having a clear figure for your daily allowance, you’re empowered to make informed choices throughout your day. Track every purchase, big or small, and compare it against your daily budget. Don’t be afraid to adjust your budget as you go along; life happens, and a good budget is flexible enough to accommodate changes.

Keeping an eye on your spending habits empowers you to make smarter choices for your financial well-being. It’s not about restriction but about liberation—the freedom that comes from knowing exactly where you stand and being able to steer your financial ship with confidence. This simple practice builds a foundation for lasting financial health, allowing you to achieve your monetary goals one day at a time.