Utilizing such a pre-designed structure streamlines the billing process, reducing potential misunderstandings and disputes. Clear documentation facilitates prompt payment, improving cash flow and reducing the administrative burden associated with collections. Standardized formats also contribute to professional record-keeping, simplifying accounting procedures and aiding in financial reporting. This improved efficiency saves time and resources for both the business and the client.

This article will further explore the various aspects of generating and managing these crucial financial documents. Specific topics covered include best practices for creating effective documents, choosing appropriate software solutions, and strategies for integrating them into existing workflows.

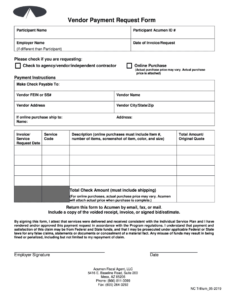

Key Components of a Payment Request Invoice

Essential elements ensure clarity and professionalism in any request for payment. These components contribute to accurate record-keeping and facilitate timely processing.

1. Issuer Information: Complete details of the business issuing the request, including the legal business name, address, contact information, and any relevant registration numbers (e.g., tax identification number).

2. Client Information: Accurate and complete details of the client or customer being billed, including their name, billing address, and contact information.

3. Invoice Number: A unique identifier assigned to each document for tracking and record-keeping purposes.

4. Issue Date: The date the document was generated.

5. Due Date: The date payment is expected.

6. Itemized Description of Services/Goods: A clear and concise description of each item or service provided, including quantity, unit price, and any applicable discounts.

7. Subtotal: The total cost of all items or services listed before taxes and any other additional charges.

8. Taxes: Any applicable taxes, clearly identified and calculated.

9. Total Amount Due: The final amount the client is obligated to pay.

10. Payment Terms: Specified conditions of payment, such as acceptable methods (e.g., credit card, bank transfer) and any applicable late payment fees.

Accurate and comprehensive documentation supports effective financial management. Inclusion of these components ensures transparency and facilitates efficient processing for both the issuer and the recipient.

How to Create a Payment Request Invoice Template

Creating a standardized template ensures consistent branding, simplifies the billing process, and reduces errors. Several approaches facilitate template creation, from basic word processing software to dedicated invoicing applications.

1. Choose a Software Solution: Select an appropriate tool based on specific needs and resources. Options range from free word processing software to dedicated invoicing platforms with advanced features.

2. Design the Layout: Establish a clear and professional layout including designated areas for essential information. Consider incorporating the business logo and utilizing a visually appealing structure.

3. Input Business Information: Include complete and accurate business details such as the legal name, address, contact information, and any relevant registration or tax identification numbers.

4. Designate Client Information Fields: Create designated fields for client details including name, billing address, and contact information.

5. Implement Numbering System: Establish a system for generating unique invoice numbers to facilitate tracking and record-keeping.

6. Define Itemized Sections: Incorporate clearly labeled sections for itemized descriptions of services or goods rendered, including quantity, unit price, and any applicable discounts.

7. Incorporate Calculation Formulas: Utilize formulas to automatically calculate the subtotal, taxes, and total amount due, minimizing manual calculations and reducing errors.

8. Include Payment Terms and Instructions: Clearly state payment terms, accepted payment methods, and instructions for submitting payments. Specify any applicable late payment fees.

A well-designed template ensures professionalism and facilitates accurate, efficient billing practices. Automated calculations and clearly defined fields contribute to streamlined workflows and reduce the likelihood of errors, ultimately benefiting both the business and its clients.

Effective financial management hinges on accurate and efficient billing practices. Standardized payment request invoice templates provide a structured framework for requesting and tracking payments, ensuring clarity, minimizing disputes, and streamlining accounting procedures. From the inclusion of essential components like issuer information, itemized descriptions, and clear payment terms, to the strategic utilization of software solutions for automated calculations and efficient workflow integration, each aspect contributes to optimized financial operations. Properly implemented templates empower businesses to maintain organized records, facilitate prompt payments, and cultivate professional client relationships.

Businesses seeking enhanced financial stability and streamlined operations should prioritize the development and implementation of robust billing systems incorporating these structured templates. Embracing such standardized processes contributes to long-term financial health and fosters positive client interactions, paving the way for sustainable growth and success. Regular review and refinement of these templates ensure adaptability to evolving business needs and contribute to ongoing process improvement.