Formalizing the credit request process offers several advantages. It creates a clear audit trail for both parties, simplifies reconciliation efforts, and minimizes potential disputes. Standardization promotes efficiency by streamlining the processing of credit notes, reducing administrative overhead, and enabling prompt adjustments to accounts. This ultimately contributes to smoother business relationships and better financial management.

Understanding the components and purpose of these formalized requests is fundamental to efficient accounting practices. The following sections will delve into the specific elements that constitute a comprehensive and effective credit note request, along with best practices for its implementation and management.

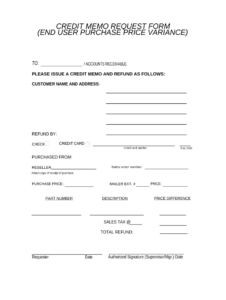

Key Components of a Credit Note Request

Effective credit note requests require specific information to ensure prompt processing and avoid misunderstandings. The following elements are essential for a comprehensive request.

1. Contact Information: Both the buyer’s and seller’s complete contact details, including company name, address, phone number, and email address, are crucial for efficient communication and processing.

2. Original Invoice Information: Clear referencing of the original invoice number, date, and total amount is essential for accurate identification and matching.

3. Reason for Credit Request: A concise and specific explanation for the request, such as damaged goods, returned items, or billing errors, is vital for proper assessment.

4. Itemized List of Products/Services: A detailed list of the specific products or services for which credit is requested, including quantities, unit prices, and the corresponding amount for each item, ensures clarity and facilitates verification.

5. Total Credit Amount Requested: The total amount of credit sought should be clearly stated and must correspond with the calculations from the itemized list.

6. Supporting Documentation: Attaching relevant documentation, such as photos of damaged goods or return shipping receipts, strengthens the request and expedites processing.

Accurate and complete information is paramount for efficient processing of credit requests. Inclusion of these elements ensures a clear understanding between buyer and seller, minimizing delays and facilitating timely resolution.

How to Create a Credit Note Request Template

Developing a standardized template streamlines the credit request process, ensuring consistency and efficiency. The following steps outline the creation of a comprehensive template.

1. Header: Begin with a clear header identifying the document as a “Credit Note Request.” Include company branding if desired.

2. Contact Information Sections: Designate separate sections for both the buyer’s and seller’s contact information. Include fields for company name, address, phone number, and email address.

3. Invoice Reference Section: Create a dedicated section for referencing the original invoice. Include fields for invoice number, date, and total amount.

4. Reason for Request Section: Provide a designated space for explaining the reason for the credit request. Include clear instructions to provide specific details.

5. Itemized Details Section: Create a table or structured format for itemizing the products or services requiring credit. Include columns for product/service description, quantity, unit price, and total amount for each item.

6. Credit Amount Summary: Include a clearly labeled field to display the calculated total credit amount requested.

7. Supporting Documentation Section: Designate a space for indicating and attaching supporting documentation.

8. Authorization Section: Include space for signatures and dates from relevant personnel within both the buyer’s and seller’s organizations, facilitating approval and processing.

A well-designed template incorporates these elements to ensure clarity, completeness, and efficiency in processing credit note requests. Consistent use of a standardized template minimizes errors, reduces processing time, and promotes clear communication between all parties.

Standardized forms for requesting credit notes are essential for efficient financial management. Understanding the key components, including accurate invoice referencing, detailed product listings, and clear justifications, ensures effective communication and facilitates timely processing. Implementing a well-designed template streamlines this process, reducing errors and promoting clarity between buyers and sellers. This structured approach to credit requests ultimately supports stronger business relationships and contributes to a more robust financial framework.

Effective management of credit requests is a critical aspect of maintaining healthy financial operations. Embracing standardized procedures and comprehensive documentation contributes to greater transparency and accountability, fostering trust and efficiency within business transactions. Proactive implementation of these practices strengthens financial stability and promotes long-term success.