Utilizing such a form streamlines the credit evaluation process, reducing time and resources spent on gathering essential information. It also promotes fairness and consistency in assessing potential trading partners, minimizing subjective biases. The structured format facilitates easy comparison and analysis of responses, leading to more accurate risk assessments and ultimately, better-informed business decisions. This proactive approach helps mitigate potential financial losses from late payments or defaults.

Understanding the components, usage, and best practices associated with these forms is essential for effective credit management. The following sections delve into these aspects, offering practical guidance for maximizing their benefits.

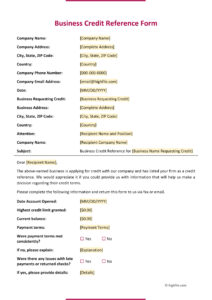

Key Components of a Trade Reference Request

Effective trade reference requests incorporate specific elements to ensure comprehensive and relevant information gathering. These components contribute to a thorough understanding of a potential trading partner’s financial reliability.

1. Contact Information: Accurate contact details of both the requesting business and the business providing the reference are essential for efficient communication and follow-up.

2. Subject Business Information: Clear identification of the business being assessed, including legal name, address, and contact person, ensures accurate referencing.

3. Credit Terms Inquiry: Specific questions regarding credit terms extended to the subject business, including credit limit and payment history, are crucial for assessing risk.

4. Payment History Inquiry: Detailed questions about the subject business’s payment promptness, frequency of late payments, and any history of defaults offer critical insights into their financial behavior.

5. Relationship History: Inquiring about the length and nature of the business relationship between the referee and the subject provides context for understanding the provided information.

6. Recommendation Request: A direct question regarding the referee’s willingness to recommend the subject business for credit provides a valuable overall assessment.

7. Confidentiality Clause: Inclusion of a confidentiality statement assures the referee that the information provided will be treated with discretion and used solely for credit assessment purposes.

8. Authorization and Signature: Space for authorized signatures from the requesting business adds formality and validity to the request.

A well-structured request form containing these key components allows for consistent data collection, facilitating a thorough and objective credit risk assessment.

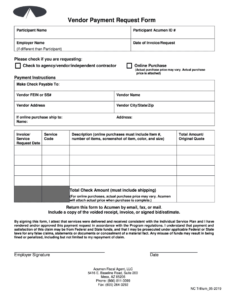

How to Create a Trade Reference Request Template

Developing a standardized trade reference request template ensures consistent data collection and facilitates efficient credit risk assessment. A well-crafted template saves time and promotes objective evaluation of potential trading partners.

1. Establish Clear Objectives: Define the specific information required to assess creditworthiness. This clarifies the scope of the request and ensures relevant data collection.

2. Design a Professional Format: Use a clear and concise layout with distinct sections for different types of information. This enhances readability and ease of completion.

3. Incorporate Essential Components: Include fields for contact information, subject business details, credit terms, payment history, relationship history, recommendation request, confidentiality clause, and authorization signatures. Each element contributes to a comprehensive understanding of the subject’s financial standing.

4. Craft Precise Questions: Formulate unambiguous questions that elicit specific and quantifiable data. Avoid open-ended questions that can lead to subjective or vague responses.

5. Ensure Clarity and Conciseness: Use straightforward language and avoid jargon. Keep the request concise to encourage prompt completion by the referee.

6. Review and Refine: Before implementation, thoroughly review the template for completeness, accuracy, and clarity. Pilot testing the template can identify areas for improvement.

7. Maintain Confidentiality: Emphasize the confidential nature of the information requested and its intended use solely for credit assessment purposes. This fosters trust and encourages candid responses.

A thoughtfully designed template, incorporating these elements, streamlines the credit evaluation process, contributing to informed decision-making and mitigating potential financial risks.

Effective credit management hinges on informed decision-making, and a standardized form for gathering trade references provides a crucial tool in this process. From outlining essential components to guiding template creation, the exploration of these forms emphasizes their value in mitigating financial risks and fostering sound business relationships. A well-structured approach to requesting and analyzing trade references empowers organizations to make data-driven decisions, optimizing credit terms and minimizing potential losses.

Implementing standardized trade reference requests contributes to a more robust and transparent credit assessment process, ultimately fostering financial stability and promoting sustainable business growth within the broader economic landscape. Diligent application of these practices positions businesses for greater success in navigating the complexities of credit risk management.