Utilizing such a pre-structured format offers several advantages. It saves time and effort by providing a ready-to-use framework. It also helps ensure professionalism and clarity, potentially enhancing the persuasiveness of the submission. Furthermore, a well-drafted format can help individuals articulate their reasons for needing a higher credit limit effectively, increasing the chances of approval.

This article will explore various aspects of requesting a credit limit increase, including crafting compelling justifications, understanding approval criteria, and alternative strategies for improving financial flexibility.

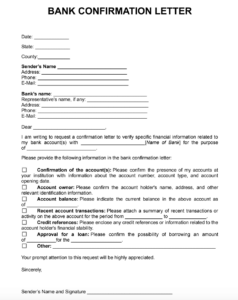

Key Components of a Credit Limit Increase Request

Effective requests for credit limit increases generally share several key components. Inclusion of these elements can significantly impact the likelihood of approval.

1: Account Information: Accurate account details, including the account number and associated card type, are essential for proper identification and processing.

2: Personal Information: Full legal name, current address, and contact information ensure clear communication and verification.

3: Current Credit Limit: Stating the existing credit limit demonstrates awareness of current financial standing.

4: Requested Credit Limit: Specifying the desired new limit provides a clear objective for the request.

5: Justification for Increase: Providing a concise and compelling reason for the increase, such as a significant salary increase or consistent on-time payments, strengthens the request. Supporting documentation may be beneficial.

6: Income and Employment Information: Current employment status, employer name, and annual income provide context for assessing financial capacity and stability.

7: Current Monthly Expenses (Optional): Providing an overview of regular expenses can offer a more complete picture of financial responsibility and available funds.

A well-structured request incorporating these elements demonstrates preparedness and a clear understanding of financial needs, leading to a more robust case for approval.

How to Create a Credit Limit Increase Request

Creating a well-structured request is essential for effectively communicating the need for a higher credit limit. The following steps outline a process for developing a comprehensive and persuasive request.

1: Gather Necessary Information: Compile all relevant account details, including the account number, card type, current credit limit, and personal information such as full legal name, address, and contact information. Income and employment details, including employer name and annual income, should also be readily available.

2: Choose a Format: A formal letter format is generally preferred, although some financial institutions may offer online forms. Regardless of the chosen format, clarity and conciseness are paramount.

3: State the Request Clearly: In the opening paragraph, clearly state the desired credit limit increase. Mentioning the current credit limit helps establish context.

4: Justify the Increase: Provide a compelling rationale for the request. Reasons such as a significant salary increase, consistent on-time payments, or major upcoming expenses should be articulated clearly and concisely. Supporting documentation, if available, can strengthen the justification.

5: Detail Financial Capacity: Include information on current income, employment status, and optionally, a summary of monthly expenses. This demonstrates financial responsibility and capacity to handle the increased credit limit.

6: Maintain a Professional Tone: A respectful and professional tone throughout the request is crucial. Avoid demanding language and focus on presenting a clear and logical case.

7: Proofread Carefully: Errors in grammar and spelling can detract from the professionalism of the request. Thorough proofreading is essential before submission.

8: Submit the Request: Follow the financial institution’s preferred submission method, whether through mail, online portals, or in-person delivery.

A comprehensive and well-structured request, supported by relevant information and a clear justification, significantly increases the likelihood of a favorable outcome. Careful attention to detail and a professional approach demonstrate financial responsibility and contribute to a stronger case for approval.

A structured format for requesting credit limit increases provides a valuable tool for managing personal finances effectively. Understanding the key components, such as clear articulation of the desired limit, comprehensive personal and financial information, and a well-reasoned justification, contributes significantly to the likelihood of approval. Careful preparation, attention to detail, and a professional approach are crucial for presenting a compelling case.

Effective credit management requires proactive engagement and informed decision-making. Leveraging available resources, such as pre-designed formats, empowers individuals to navigate the complexities of credit and achieve greater financial flexibility. The ability to articulate financial needs effectively is a valuable skill that supports long-term financial well-being.