Running a small business is a whirlwind of activity, passion, and often, unexpected challenges. Amidst the daily hustle of serving customers, managing staff, and innovating your products or services, it’s easy for financial planning to feel like an intimidating chore. However, gaining a clear picture of where your money comes from and where it goes is not just good practice; it’s absolutely crucial for sustainable growth and peace of mind.

Many small business owners find themselves reacting to financial situations rather than proactively managing them. This reactive approach can lead to cash flow issues, missed opportunities, and unnecessary stress. Imagine knowing exactly how much you can invest in marketing next month, or how much you need to save for that big equipment upgrade. That level of foresight is invaluable.

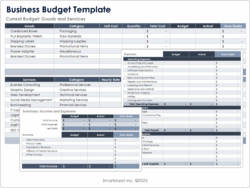

This is where a structured approach, specifically a small business monthly budget template, becomes your best friend. It transforms abstract financial data into actionable insights, helping you make smarter decisions and steer your business towards profitability and stability. Let’s explore why this tool is so vital and how you can implement one effectively.

Building Your Financial Roadmap: The Power of a Monthly Budget

Think of your monthly budget as the GPS for your business’s financial journey. Without it, you might be driving aimlessly, hoping to reach your destination. With a budget, you have a clear map, knowing where you are, where you’re going, and what turns you need to take. For small businesses, this clarity is paramount. It helps identify spending patterns, allocate resources wisely, and plan for future investments or unforeseen circumstances.

One of the primary benefits is gaining control over your cash flow. Many businesses struggle not because they aren’t profitable, but because they don’t manage their cash effectively. A budget forces you to look at your inflows and outflows, ensuring you have enough liquidity to cover your operational costs. This proactive management can prevent those stressful moments when bills come due and the bank account looks a little thin.

Moreover, a well-structured budget helps you set realistic financial goals. Whether it’s increasing your profit margin by a certain percentage, saving for a down payment on a new office, or expanding your product line, having a detailed budget allows you to quantify these goals and track your progress towards them. It turns vague aspirations into concrete, measurable targets.

A template also makes it easier to spot inefficiencies and areas where you might be overspending. Perhaps you’re paying for software subscriptions you no longer use, or your utility bills are higher than they should be. By categorizing and reviewing your expenses regularly, these hidden drains on your finances become visible, giving you the opportunity to cut unnecessary costs and reallocate funds to more productive areas of your business.

Finally, a budget acts as a benchmark. It’s not just about predicting the future; it’s about comparing your actual performance against your planned performance. This comparison provides invaluable feedback, allowing you to understand what’s working and what isn’t, and to make necessary adjustments to your business strategy. It’s a dynamic tool that evolves with your business.

Understanding Your Income Streams

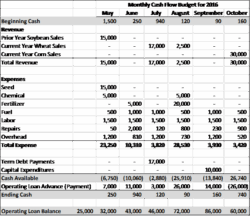

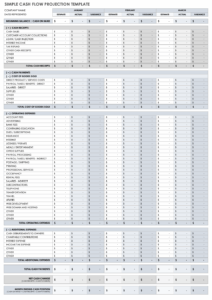

The first step in any budgeting process is to clearly identify all sources of income. This might seem straightforward, but it’s important to be thorough. Think beyond just sales revenue. Do you have income from consulting, licensing, affiliate programs, or interest on savings? List every single way money comes into your business. For services, track billable hours and project fees. For products, note units sold and average price points. This granular detail provides a solid foundation for projecting your monthly income.

Tracking Your Expenses

This is often the most revealing part of the budgeting process. Expenses fall into two main categories: fixed and variable. Fixed expenses are those that generally stay the same each month, regardless of your business activity. Variable expenses fluctuate based on your sales volume or operational needs. Accurately tracking these is crucial for financial health.

- Rent or Mortgage: Your primary business location cost.

- Utilities: Electricity, water, internet, and gas.

- Salaries and Wages: Employee compensation, including payroll taxes and benefits.

- Insurance: Business liability, property, and workers’ compensation.

- Loan Payments: Monthly payments for any business loans.

- Software Subscriptions: Essential tools for accounting, CRM, project management, etc.

- Marketing and Advertising: Costs for campaigns, social media ads, SEO services.

- Supplies and Inventory: Raw materials, office supplies, products for resale.

- Travel and Entertainment: Costs associated with business trips or client meetings.

- Professional Services: Accountants, legal counsel, consultants.

- Maintenance and Repairs: Upkeep for equipment, vehicles, or property.

Implementing and Maintaining Your Monthly Budget

Having a small business monthly budget template is one thing; making it a living, breathing part of your business operations is another. The key to successful budgeting lies in consistent implementation and regular review. Start by gathering all your financial data from previous months – bank statements, credit card statements, invoices, and receipts. This historical data will provide a realistic baseline for your projections.

Once you’ve populated your template with projected income and expenses for the upcoming month, don’t just file it away. Schedule regular check-ins, ideally once a week or bi-weekly, to compare your actual performance against your budgeted figures. This proactive monitoring allows you to catch discrepancies early and make necessary adjustments. For instance, if your marketing spend is unexpectedly high, you can decide to cut back elsewhere or find more cost-effective strategies.

Remember, a budget isn’t a rigid, unchangeable document. It’s a flexible tool that needs to adapt as your business evolves. Market conditions change, new opportunities arise, and unexpected expenses can crop up. Be prepared to revise your budget throughout the year. The goal isn’t perfection from day one, but rather continuous improvement and informed decision-making based on real-time financial data.

- Automate where possible: Use accounting software that integrates with your bank accounts to automatically track and categorize transactions.

- Be realistic: Don’t underestimate expenses or overestimate income. It’s better to be conservative.

- Build an emergency fund: Always allocate a portion of your budget towards unexpected costs or slow periods.

- Involve your team: If applicable, involve key team members in the budgeting process to foster a sense of shared responsibility and understanding.

- Seek professional advice: Consider working with an accountant or financial advisor to ensure your budget is comprehensive and aligns with your business goals.

Embracing a systematic approach to your finances through a monthly budget template can genuinely transform your small business. It moves you from a state of financial guesswork to one of clarity and control, allowing you to confidently plan for both the immediate future and long-term growth. This disciplined practice empowers you to allocate resources strategically, identify potential pitfalls, and seize opportunities with greater certainty.

Ultimately, financial mastery is a cornerstone of business success. By integrating a regular budgeting process into your operations, you’re not just tracking numbers; you’re building a stronger, more resilient foundation for your entrepreneurial journey, ensuring your passion for your business is matched by robust financial health.