Using a standardized form offers several advantages. It clarifies the request, reducing ambiguity and potential delays. It also helps organizations process requests more efficiently by providing all necessary information in a consistent format. Furthermore, these templates often include helpful guidance and explanations, ensuring individuals understand their rights and the information they are entitled to receive. This empowered approach can lead to quicker resolution and greater transparency in the process.

This article explores the key components of these data access forms, offering practical guidance on completing them accurately and effectively. It also delves into the legal framework surrounding data access requests, providing a comprehensive understanding of individual rights and organizational responsibilities.

Key Components of a Data Access Request for PPI Information

Effective data access requests concerning PPI information require specific elements to ensure clarity and completeness. These components facilitate efficient processing and comprehensive responses from organizations holding the requested data.

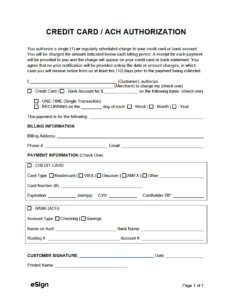

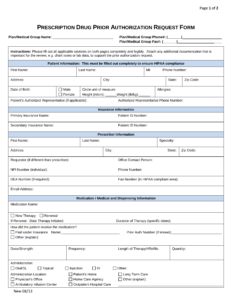

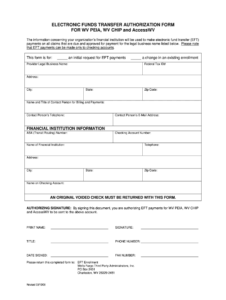

1: Identification of the Requester: Clear identification of the individual making the request is essential. This typically includes full legal name, current address, and any previous names or addresses used during the period the PPI policy was active.

2: Specifics of the PPI Policy: Details about the PPI policy in question are crucial. This might include the policy number, the name of the product the PPI was associated with (e.g., loan, credit card), and the dates the policy was active.

3: Information Being Requested: Clearly specifying the information sought is paramount. This might encompass policy documents, communications related to the policy, details of payments made, and any other relevant data held by the organization.

4: Proof of Identity: Organizations often require proof of identity to verify the requester’s identity and protect data privacy. Acceptable forms of identification might include copies of passports, driving licenses, or utility bills.

5: Contact Information: Providing clear contact details, such as an email address and phone number, enables the organization to communicate effectively with the requester regarding the progress of their request.

6: Signature and Date: Signing and dating the request adds formality and confirms the requester’s intent.

Accurate completion of these elements ensures data access requests are handled efficiently, leading to timely retrieval of the necessary PPI information. This comprehensive approach facilitates transparency and clarity throughout the process.

How to Create a Data Access Request for PPI Information

Creating a comprehensive data access request for PPI information requires careful attention to detail and inclusion of all necessary elements. A well-structured request facilitates efficient processing by the organization holding the data and ensures the requester receives all relevant information.

1: Obtain a Template: Utilizing a template ensures all necessary components are included and helps maintain a standardized format. Templates are often available from regulatory bodies or consumer advocacy organizations.

2: Personal Information: Provide complete and accurate personal details, including full legal name, current address, and any previous names or addresses used during the period the PPI policy was active. This ensures clear identification of the requester.

3: PPI Policy Details: Include all known details about the PPI policy, such as the policy number, the associated product (loan, credit card, etc.), and the dates the policy was in effect. Specific details help organizations locate the relevant information efficiently.

4: Specify Requested Information: Clearly articulate the specific information being requested. This might include policy documents, correspondence, payment records, or any other relevant data pertaining to the PPI policy.

5: Include Proof of Identity: Attach copies of acceptable identification documents, such as a passport, driver’s license, or utility bill. This verifies the requester’s identity and safeguards data privacy.

6: Contact Information: Provide clear contact details, such as an email address and phone number, enabling efficient communication regarding the request’s progress.

7: Sign and Date: Signing and dating the request formalizes the process and confirms the requester’s intent.

8: Submit the Request: Follow the organization’s specified submission method, whether through postal mail, email, or an online portal. Retaining a copy of the submitted request is recommended.

Following these steps ensures a comprehensive and effective data access request, enabling organizations to process the request efficiently and provide the requester with the necessary information regarding their PPI policy.

Standardized forms for requesting access to PPI information provide a crucial framework for individuals seeking to exercise their data rights. These templates ensure requests are comprehensive, covering essential identifying information, policy specifics, and the precise data sought. This structured approach facilitates efficient processing by organizations, promoting transparency and timely access to relevant information. Furthermore, the use of templates empowers individuals by providing a clear and accessible pathway to understanding and obtaining personal data related to PPI policies.

Access to accurate and complete information regarding PPI is essential for individuals seeking clarity about their financial history. Utilizing these standardized request forms plays a vital role in enabling informed decisions and fostering greater transparency within the financial sector. The ability to access this information efficiently empowers individuals to understand their rights and navigate the complexities of PPI policies effectively.