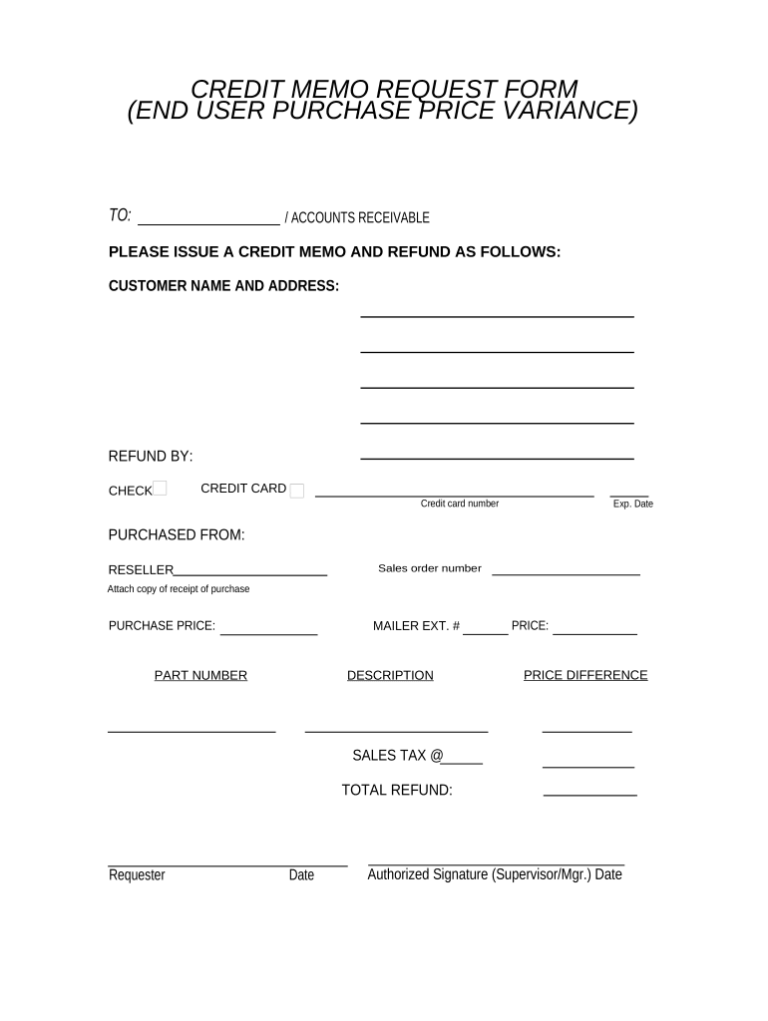

Formalizing the credit request process offers several advantages. It creates a clear audit trail for both parties, simplifies reconciliation efforts, and minimizes potential disputes. Standardization promotes efficiency by streamlining the processing of credit notes, reducing administrative overhead, and enabling prompt adjustments to accounts. This ultimately contributes to smoother business relationships and better financial management.

credit

Credit Note Request Template

Utilizing such a form offers several advantages. It streamlines the credit request process, allowing businesses to handle returns and adjustments efficiently. This efficiency reduces administrative overhead and speeds up the reimbursement or account adjustment process for customers. Furthermore, a standardized approach minimizes errors and promotes accurate record-keeping, which benefits both the buyer and the seller. A clear audit trail is created, facilitating financial reconciliation and minimizing disputes.

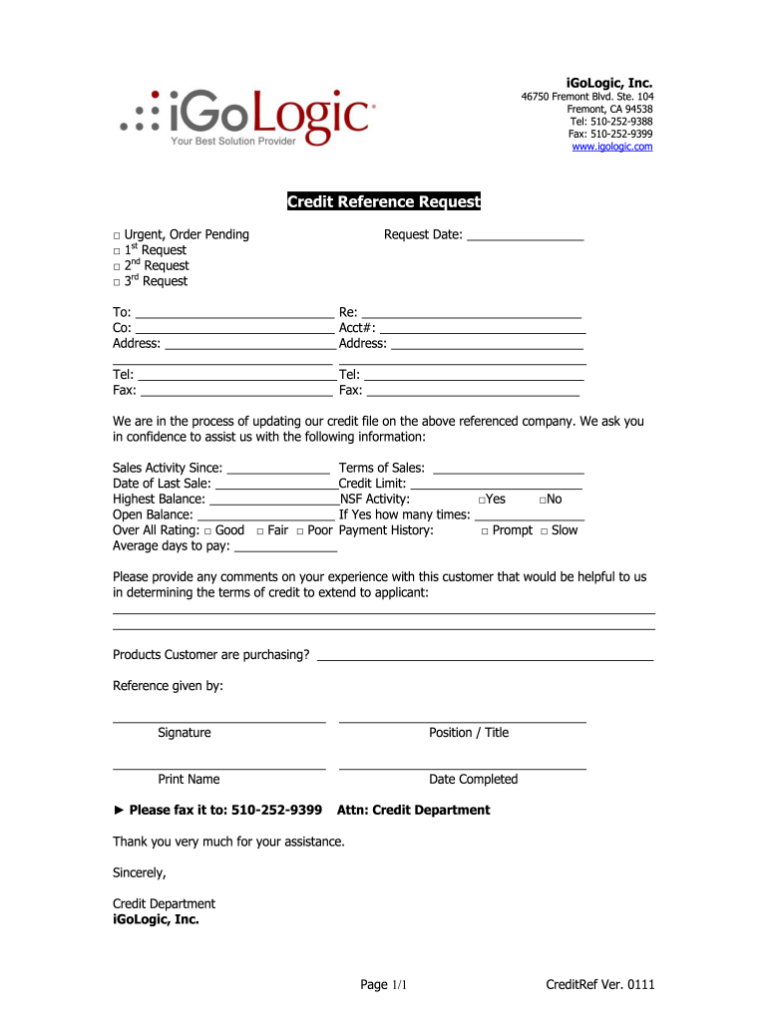

Credit Reference Request Template

Utilizing a pre-designed structure offers several advantages. It reduces the time and effort required to collect essential financial data, minimizes the risk of overlooking critical information, and promotes objectivity in credit evaluations. This systematic approach also allows for easier comparison across different applicants or clients and contributes to a more efficient and reliable credit approval process. Improved risk management and reduced potential for financial losses are key outcomes of this organized method.

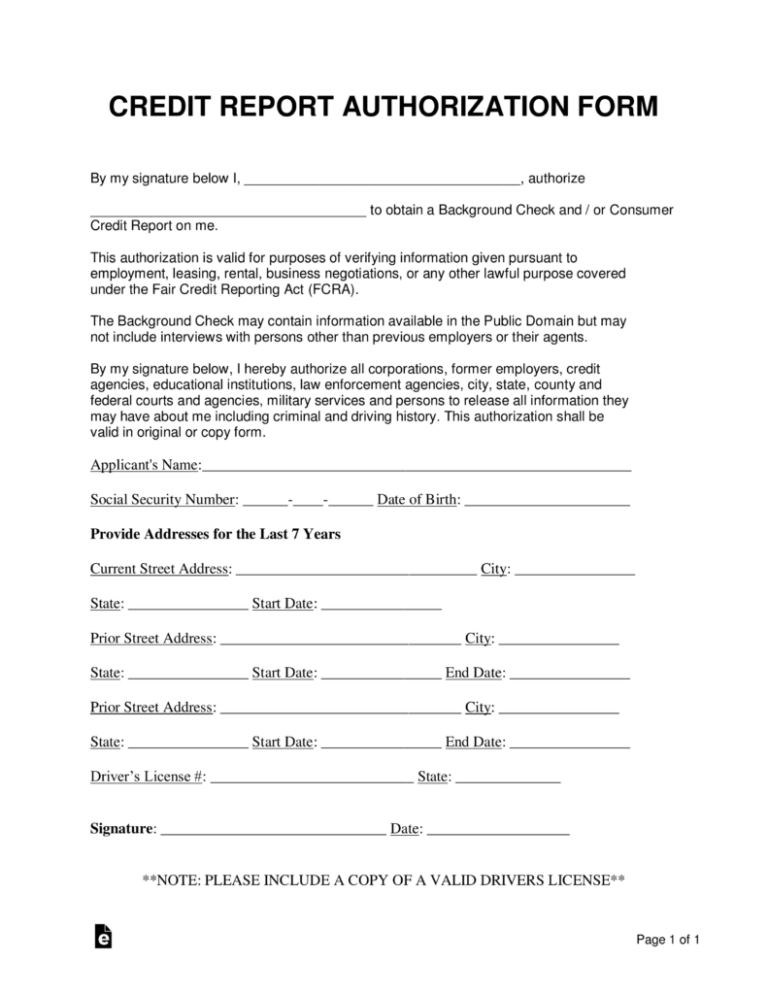

Authorization To Pull Credit Template

- The name of the person or entity authorizing the credit pull

- The name of the person or entity whose credit report is being pulled

- The purpose of the credit pull

- The date of the authorization

- The signature of the authorized party

Authorization to pull credit templates can be used for various purposes, such as:

Authorization To Pick Up Credit Card Template

There are many benefits to using an “authorization to pick up credit card template.” First, it helps to protect the cardholder from fraud. By requiring the authorized person to present identification, the cardholder can be sure that the person picking up the card is who they say they are. Second, it helps to ensure that the card is delivered to the correct person. By providing the authorized person with a specific time and place to pick up the card, the cardholder can be sure that the card will not be lost or stolen.

Authorization Letter To Receive Credit Card Template

There are several benefits to using an Authorization Letter to Receive a Credit Card template:

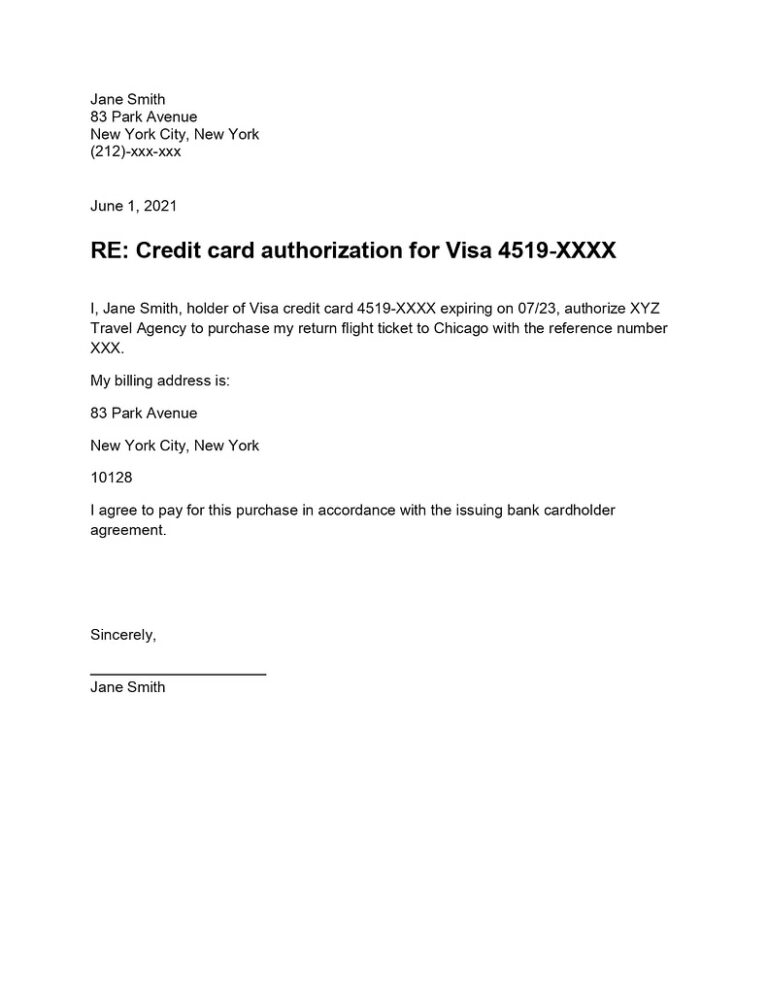

Authorization Letter For Credit Card Payment Template

There are many benefits to using an authorization letter for credit card payment. First, it can help to protect you from fraud. By providing your credit card information in writing, you are creating a record of the transaction that can be used to dispute any unauthorized charges. Second, an authorization letter can help to speed up the payment process. By providing all of the necessary information upfront, you can avoid delays that may occur if the merchant needs to contact you for additional information.

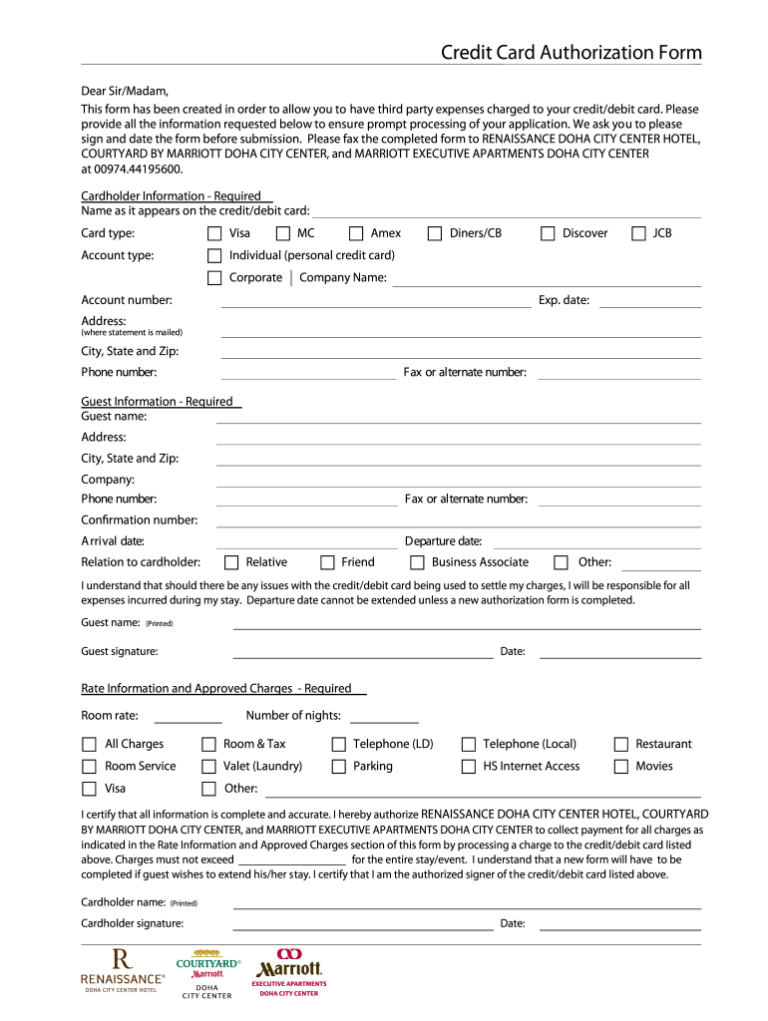

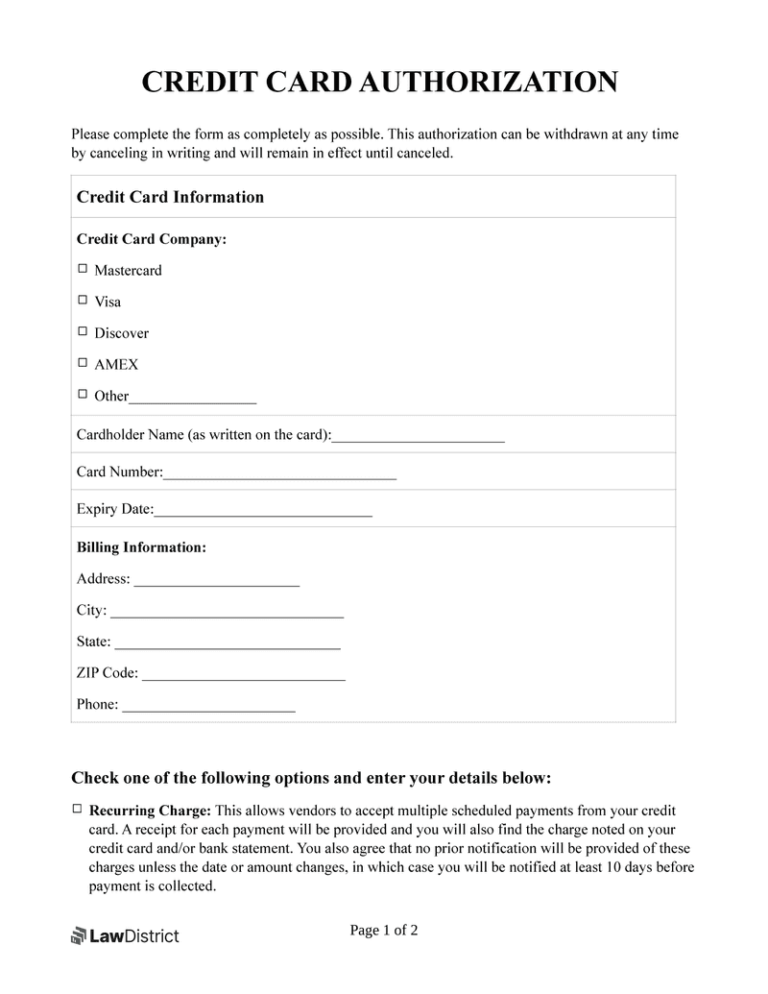

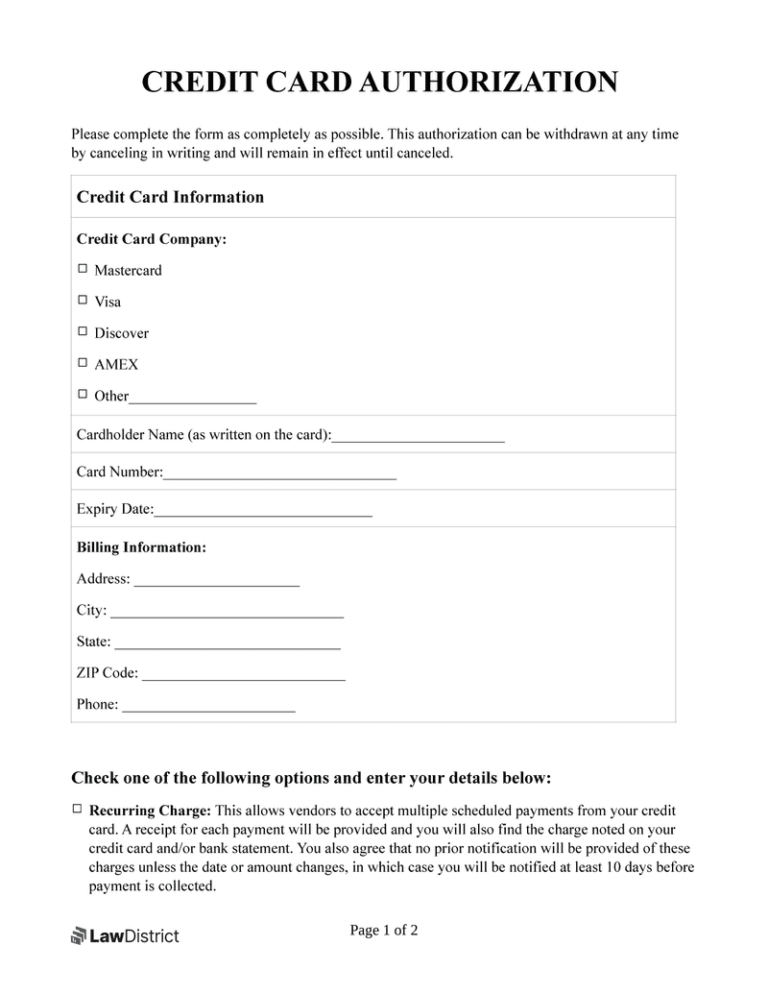

Third Party Credit Card Authorization Form Template

There are many benefits to using a third party credit card authorization form template. First, it can help to protect the business from fraud. By requiring the customer to provide their signature, the business can help to ensure that the customer is who they say they are. Second, it can help to streamline the payment process. By providing the third party with all of the necessary information upfront, the business can help to avoid delays in processing the payment.

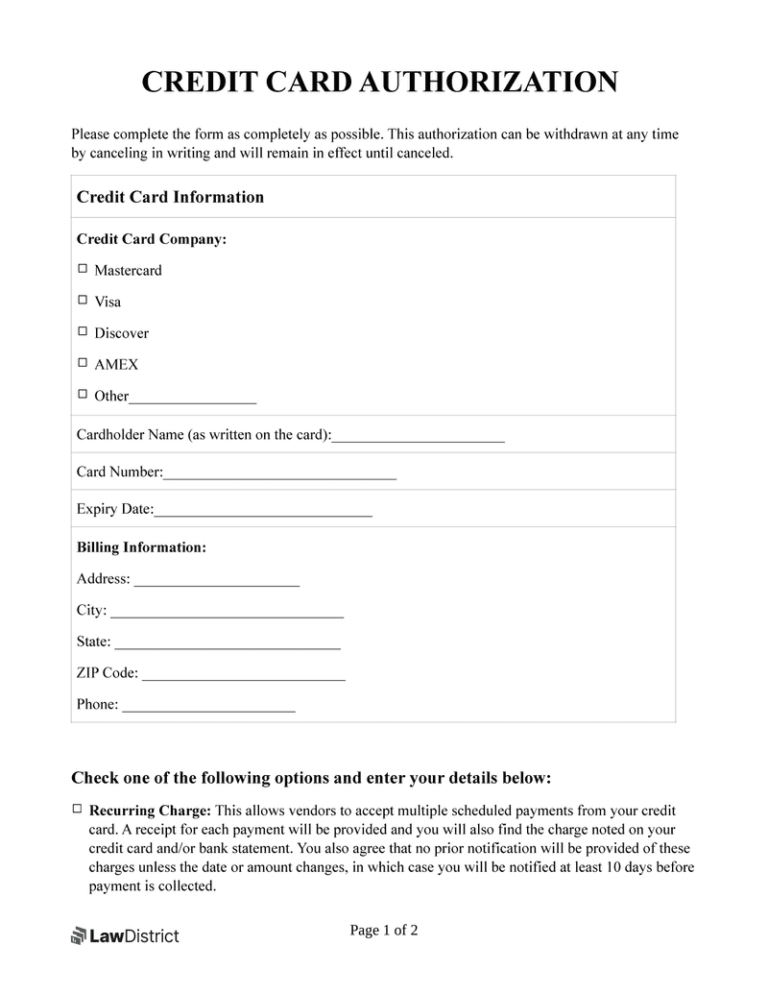

Standard Credit Card Authorization Form Template

Credit card authorization forms are important because they help businesses protect themselves from fraud and ensure that customers are authorized to make purchases.

Generic Credit Card Authorization Form Template

Using a generic credit card authorization form template has several benefits. First, it can save businesses time and effort by providing a pre-formatted document that they can simply fill out. Second, it can help to ensure that all of the necessary information is collected from the customer, which can reduce the risk of errors. Third, it can help to protect businesses from fraud by providing a record of the customer’s authorization to use their credit card.