Utilizing such a form streamlines the credit evaluation process, reduces the risk of bad debt, and fosters stronger relationships with suppliers by demonstrating a professional and organized approach to credit management. This proactive approach to credit assessment contributes to a more stable and predictable financial environment for all parties involved.

This article will further explore the key components of these forms, best practices for their use, and strategies for maximizing their effectiveness in managing credit risk.

Key Components of a Trade Reference Request

Effective requests for trade references incorporate several key elements to ensure the collection of comprehensive and relevant information. These components facilitate a thorough understanding of a business’s creditworthiness and payment practices.

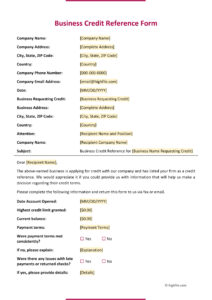

1: Contact Information: Clear identification of the requesting business, including company name, address, and contact person details, is essential.

2: Subject Business Information: The request must clearly identify the business being evaluated, including its legal name, address, and contact information.

3: Credit Terms Inquiry: Specific questions regarding the subject business’s credit terms, such as credit limits extended and payment terms offered, should be included.

4: Payment History Inquiry: Inquiries about the subject business’s payment history, including frequency of late payments and any instances of non-payment, are crucial.

5: Relationship History Inquiry: Understanding the length and nature of the supplier’s relationship with the subject business provides valuable context.

6: Confidentiality Assurance: Including a statement assuring the confidentiality of the information provided encourages open and honest feedback.

7: Authorization Request: A clear request for authorization to contact the reference is necessary to ensure compliance with privacy regulations.

A well-designed form incorporating these elements allows for efficient collection of critical data points, enabling informed credit decisions and mitigating potential risks.

How to Create a Trade Reference Request

Developing a standardized trade reference request form ensures consistency in data collection and facilitates efficient credit evaluations. A well-structured template promotes thoroughness and helps mitigate potential risks associated with extending credit.

1: Establish Clear Identification: Begin by clearly identifying the requesting business. Include the company name, full address, phone number, and email address of the contact person.

2: Specify Subject Business Details: Provide complete details about the business under evaluation. Include the legal name, address, and all relevant contact information.

3: Outline Credit Terms Inquiry: Structure specific questions regarding credit terms offered to the subject business by the reference. This should include inquiries about credit limits and payment terms.

4: Detail Payment History Inquiry: Formulate pointed questions regarding the subject business’s payment history with the reference. Inquire about the frequency of late payments, average payment times, and any history of non-payment or disputes.

5: Include Relationship History Inquiry: Request information regarding the duration and nature of the business relationship between the reference and the subject business.

6: Incorporate Confidentiality Assurance: Include a statement ensuring the confidentiality of the information provided. This encourages candid and comprehensive responses.

7: Include Authorization Request: Explicitly request authorization from the reference to discuss the subject business’s credit history. This demonstrates respect for privacy and adheres to best practices.

8: Offer Multiple Response Options: Provide various response options, such as online forms, email, or fax, to accommodate the preferences of the reference and facilitate prompt responses.

A comprehensive trade reference request gathers essential information for informed credit decisions. A standardized format enhances efficiency, promotes consistency, and contributes to a more robust credit risk management process.

Standardized forms for requesting trade references provide a crucial framework for assessing the creditworthiness of potential business partners. They facilitate the systematic collection of essential information regarding payment history, credit terms, and the overall financial stability of businesses seeking credit. A well-designed template ensures consistency in data gathering, enabling objective evaluations and informed decision-making. Understanding the key components of these forms and implementing best practices in their use is essential for effective credit risk management.

Implementing robust credit evaluation processes, supported by thorough trade reference checks, strengthens financial stability and fosters trust within business relationships. This proactive approach to credit management contributes to a more secure and predictable business environment, mitigating potential risks and promoting sustainable growth.