In the dynamic world of business, managing finances effectively is not just about tracking expenses; it’s about making every dollar work smarter for you. Many businesses rely on traditional budgeting methods, often rolling over previous year’s figures with minor adjustments. While convenient, this approach can sometimes carry forward inefficiencies and outdated spending habits, leaving valuable resources untapped. It’s a bit like driving while constantly looking in the rearview mirror, perhaps missing new opportunities or hidden potholes ahead.

This is where a fresh perspective, like that offered by a zero based budget template for business, can truly revolutionize your financial planning. Instead of merely tweaking last year’s budget, zero-based budgeting demands that every single expense be justified from scratch, as if you’re starting with a clean slate. It forces a rigorous examination of all costs, ensuring that every penny spent aligns directly with current business objectives and priorities. This proactive approach helps identify wasteful spending and reallocate funds to areas that offer the greatest return and strategic value.

Embracing zero-based budgeting isn’t just about cutting costs; it’s about fostering a culture of financial accountability and strategic resource allocation throughout your organization. It encourages managers to think critically about their departmental needs and present compelling justifications for every expense, promoting a deeper understanding of how each expenditure contributes to the company’s overall success. Let’s delve deeper into why this methodology, supported by a well-designed template, could be the game-changer your business needs.

Why a Zero-Based Budget Can Transform Your Business Finances

Imagine starting each financial period with an empty budget sheet. That’s the core idea behind zero-based budgeting. Instead of simply adjusting last year’s numbers, every expense, every activity, and every project must be justified anew, from a “zero base.” This process forces a thorough review of all operations, ensuring that resources are allocated based on current needs and strategic goals, rather than historical spending patterns. It’s an intense but incredibly rewarding exercise that can uncover significant opportunities for efficiency.

One of the most compelling benefits is the dramatic improvement in resource allocation. When every department has to justify its entire budget from scratch, it naturally leads to a more critical evaluation of what truly adds value. Funds previously allocated out of habit can now be redirected to more pressing strategic initiatives, innovative projects, or areas of growth that were previously starved of capital. This isn’t just about cost-cutting; it’s about optimizing your investment in every facet of your business operations.

Moreover, zero-based budgeting fosters a heightened sense of accountability throughout the organization. Managers are no longer just custodians of a budget; they become advocates for their spending, responsible for demonstrating the value and necessity of every expense. This encourages a more entrepreneurial mindset, where everyone is thinking about how to achieve objectives with maximum efficiency and impact. It shifts the focus from “how much did we spend last year?” to “what do we truly need to achieve our goals this year?”

Key Principles of Zero-Based Budgeting

To truly grasp the power of zero-based budgeting, it’s helpful to understand its fundamental principles. These guiding ideas ensure that the process delivers maximum value and insight.

First, the identification of “decision packages” is crucial. This means breaking down all activities and functions into manageable units that can be analyzed and evaluated independently. Each package outlines the activity, its purpose, the resources required, and the benefits it delivers. It’s like building your business budget block by block, ensuring each block has a solid foundation and a clear role.

Second, every expense within these decision packages must be thoroughly justified. This isn’t a casual nod to necessity; it’s a deep dive into why this particular expense is essential for achieving specific objectives. If an expense cannot be justified, it simply doesn’t make it into the budget. This rigorous scrutiny helps eliminate redundant costs and ensures every dollar is purposeful.

Finally, prioritizing these justified activities is key. Once all decision packages are developed and justified, they are ranked based on their contribution to the company’s strategic goals. This allows leadership to make informed decisions about where to allocate limited resources, ensuring that the most critical and impactful activities receive funding first. It’s a transparent and objective way to decide what truly matters most for the business.

Implementing Your Zero-Based Budget Template for Business

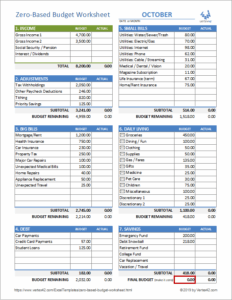

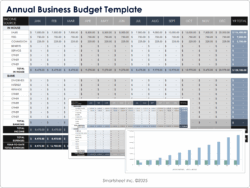

Getting started with zero-based budgeting might seem daunting, given its comprehensive nature. However, utilizing a well-structured zero based budget template for business can significantly streamline the entire process, making it much more manageable and less intimidating for your team. These templates often provide predefined categories, prompts for justification, and frameworks for prioritizing, guiding you step-by-step through what would otherwise be a complex undertaking. They act as a roadmap, ensuring no critical step is missed and all necessary information is captured.

The implementation process typically begins with a detailed review of all current activities and expenses within each department or cost center. This involves asking fundamental questions: What activities do we perform? Why are they necessary? What would happen if we stopped them? How much do they cost, and is there a more efficient way to achieve the same outcome? The template helps organize these questions and the resulting justifications in a consistent format across the organization, making comparison and consolidation much easier.

Once all activities and their associated costs have been identified and justified, the template facilitates the crucial step of prioritization. By clearly outlining the value proposition of each expense or project, management can collectively rank them according to strategic importance and allocate funds accordingly. This systematic approach ensures that even in times of limited resources, funding is directed towards areas that will yield the greatest impact and support the business’s overarching mission.

- Step 1: Identify all activities and functions within your business.

- Step 2: Justify every single expense associated with these activities from scratch.

- Step 3: Evaluate alternatives for performing each activity more cost-effectively.

- Step 4: Prioritize all activities based on their alignment with strategic objectives.

- Step 5: Allocate resources to the highest-priority activities, building the budget from the ground up.

- Step 6: Monitor budget adherence regularly and make adjustments as business needs evolve.

Adopting a zero-based approach with a well-designed template is more than just a budgeting exercise; it’s a strategic shift that empowers businesses to operate with greater agility, transparency, and financial discipline. It encourages a proactive mindset where every dollar is intentionally spent to drive specific outcomes, rather than simply maintaining the status quo. This disciplined approach ensures that your financial resources are always aligned with your most critical business goals, fostering sustained growth and profitability.

By consistently scrutinizing every expense and linking it directly to organizational objectives, businesses can cultivate a culture of continuous improvement and strategic thinking. This not only leads to significant cost savings and improved efficiency but also enhances decision-making across all levels of the company. It’s about building a financial framework that is robust, responsive, and perfectly tailored to the evolving needs and aspirations of your enterprise.