Diving into the world of personal finance can often feel like navigating a complex maze. Many of us have tried various budgeting methods, only to find them either too rigid, too vague, or simply not sticky enough to make a lasting difference. The goal is always the same: to gain control over our money, reduce stress, and work towards our financial aspirations, whatever they may be.

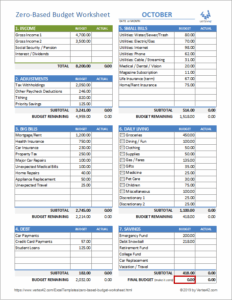

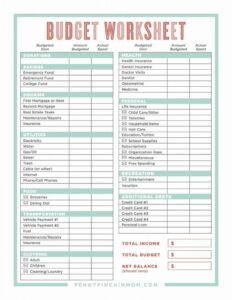

One powerful strategy that has helped countless individuals transform their financial habits is zero-based budgeting. It’s a method that ensures every single dollar you earn has a specific job, giving you complete clarity and intentionality with your spending. When you’re looking for a structured way to implement this, a well-designed zero based monthly budget template becomes an invaluable tool, simplifying the process and making it accessible for everyone.

Imagine knowing exactly where your money goes each month, without any lingering questions or surprises. That’s the peace of mind a zero-based approach offers. It’s not about restriction as much as it is about allocation, making sure your hard-earned cash is serving your goals rather than disappearing without a trace. Let’s explore how this method works and how you can put it into action.

What Exactly is a Zero-Based Budget and Why It Matters

At its core, zero-based budgeting means that your income minus your expenses should equal zero. This isn’t about emptying your bank account; it’s about assigning every dollar a category, whether that’s a bill, savings, debt repayment, or even discretionary spending. Think of it like giving every dollar a name and a mission before the month even begins. Instead of simply tracking what you spent, you’re proactively deciding what you will spend.

This method drastically shifts your financial perspective from reactive to proactive. Traditional budgeting often leaves “leftover” money, which can then be spent without a clear purpose. With a zero-based approach, there are no “leftovers.” Every dollar is accounted for, forcing you to make conscious decisions about where it should go. This intentionality is incredibly powerful, helping to prevent impulse spending and ensuring you’re always moving towards your financial objectives.

The beauty of this system lies in its ability to highlight areas where you might be overspending or where you could reallocate funds more effectively. It brings a level of transparency to your finances that many other budgeting methods simply don’t. By regularly reviewing and adjusting your allocations, you become intimately familiar with your financial landscape, empowering you to make smarter choices day after day.

Key Principles to Adopt

- **Account for Every Dollar:** This is the cornerstone. Ensure your total income for the month is fully distributed among all your expense categories, savings, and debt payments, leaving a “zero” balance.

- **Prioritize Your Needs and Goals:** Start by allocating funds to essential expenses like housing, food, and utilities, then move to debt repayment, savings goals, and finally, discretionary spending.

- **Track Your Spending Diligently:** While the budget is a plan, tracking is how you ensure you stick to it. Regularly compare your actual spending against your budgeted amounts.

- **Review and Adjust Monthly:** Life happens, and your budget should be flexible. At the end of each month, review how you did and make adjustments for the upcoming month based on new circumstances or insights.

Embracing these principles allows you to gain an unparalleled level of control. It moves beyond just categorizing expenses; it instills a discipline where every financial decision is a deliberate one. This process encourages you to think critically about your values and how your money can best serve them.

Ultimately, a zero-based approach isn’t just about managing money; it’s about managing your financial future. It’s about building a robust framework that supports your ambitions, from paying off a credit card to saving for a down payment or an early retirement. When effectively utilized, a zero based monthly budget template becomes your financial compass, guiding you toward greater stability and prosperity.

Getting Started with Your Own Template

The idea of a zero-based budget might sound intense, but setting it up with a good template is surprisingly straightforward. You don’t need to be a financial guru; just a willingness to look at your money with fresh eyes. The first step is to gather all your income sources and then list every single expense you anticipate for the month. This includes fixed bills like rent or mortgage, variable expenses like groceries and utilities, and even those smaller, often overlooked costs like subscriptions or an occasional coffee.

Once you have a clear picture of your income and all potential expenditures, you begin assigning every dollar. This is where the magic happens. If you have money left over after covering all your essentials and planned spending, don’t just leave it. Assign it a job! That could mean putting it towards an emergency fund, an investment account, or perhaps an extra payment on a debt. The key is that it doesn’t just sit idle; it actively contributes to your financial goals.

Many people find that using a spreadsheet, whether in Excel or Google Sheets, provides the ideal framework for their zero based monthly budget template. There are also numerous budgeting apps that can help automate this process, syncing with your bank accounts to track spending in real-time. The best tool is the one you’ll actually use consistently. Don’t be afraid to experiment to find what fits your lifestyle and preferences best.

- **Determine Your Monthly Income:** Add up all your take-home pay for the month.

- **List All Fixed Expenses:** These are your consistent bills (rent, loan payments, insurance).

- **Estimate Variable Expenses:** Categories like groceries, entertainment, and transportation require careful estimation.

- **Allocate for Savings and Debt Repayment:** Treat these as non-negotiable “expenses” in your budget.

- **Assign Every Remaining Dollar:** If money is left, assign it to a category, ensuring your income minus expenses equals zero.

- **Monitor and Adjust:** Regularly check your spending against your budget and make necessary tweaks.

Adopting this budgeting method transforms how you interact with your money. It brings clarity, reduces financial anxiety, and puts you firmly in the driver’s seat of your financial future. By committing to this intentional approach, you empower yourself to make informed decisions that align with your long-term aspirations, leading to a greater sense of financial peace and security.

The journey to financial well-being is ongoing, and a well-structured budget is a crucial component of that path. By meticulously planning and allocating your resources each month, you’re not just managing money; you’re building habits that will serve you well for years to come, paving the way for a more stable and prosperous life.