Embarking on the journey to buy your first home or even moving to a new one is incredibly exciting. It’s a significant milestone, a place where memories will be made, and a cornerstone of your future. However, beneath all that anticipation lies a crucial layer of financial planning that can feel quite daunting if you don’t approach it strategically. The dream of homeownership is wonderful, but the practical steps to get there require careful consideration of your finances.

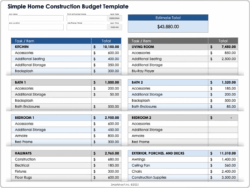

This is precisely where a well-structured buying a house budget template becomes your best friend. It’s more than just a spreadsheet; it’s a roadmap that guides you through the complexities of home financing, helping you understand where your money is going and how much you can realistically afford. Without a clear budget, it’s easy to get swept away by the excitement, potentially overextending yourself or encountering unexpected costs that can derail your plans.

By taking the time to create and follow a comprehensive budget, you empower yourself with knowledge and control. You’ll be able to confidently navigate negotiations, make informed decisions, and ultimately secure a home that fits comfortably within your financial means, ensuring peace of mind for years to come.

Understanding the Core Components of Your Home Buying Budget

When you start thinking about buying a house, your mind probably jumps straight to the sale price. While that’s undeniably the biggest number, it’s just one piece of a much larger financial puzzle. A comprehensive budget needs to account for a variety of costs, both upfront and ongoing, to give you a true picture of affordability. Overlooking any of these can lead to significant stress down the line.

The first major component is your down payment. This is the initial lump sum you pay towards the home’s purchase price. Lenders typically look for anywhere from 3.5% to 20% or more, depending on the loan type and your financial situation. A larger down payment can mean lower monthly mortgage payments and potentially better interest rates, but it also requires more savings upfront.

Next, you have closing costs. These are a collection of fees associated with finalizing your mortgage and transferring ownership of the property. They can include appraisal fees, loan origination fees, title insurance, recording fees, and attorney fees, among others. Closing costs usually range from 2% to 5% of the loan amount, so they can add up quickly and need to be factored into your immediate savings goal.

Once you own the home, you’ll be responsible for ongoing expenses. The most obvious is your mortgage payment, which includes principal and interest. But don’t forget property taxes, which are assessed by your local government and can vary widely, and homeowner’s insurance, which protects your investment from damage. These three, often bundled together as PITI (Principal, Interest, Taxes, Insurance), form the bulk of your monthly housing expense.

It’s also wise to consider utilities and potential homeowner association (HOA) fees if you’re looking at a condo or a planned community. These are regular, non-negotiable expenses that impact your monthly cash flow. Neglecting to account for them can significantly tighten your budget and make living in your new home more financially challenging than anticipated.

Beyond the Basics: Hidden Costs to Consider

Even with a detailed budget, some costs often surprise first-time homebuyers. Being aware of these potential expenditures beforehand can save you from financial strain shortly after moving in. These are the "what-ifs" and the "would-be-nice-to-haves" that suddenly become necessities.

- **Moving Expenses:** The cost of hiring movers, renting a truck, or simply buying packing supplies can add up.

- **Immediate Repairs and Renovations:** Even in a move-in ready home, there might be small fixes, paint jobs, or essential upgrades you want to tackle right away.

- **New Furniture and Appliances:** Your old sofa might not fit, or you might need a new refrigerator. Factor in potential furnishing costs.

- **Home Inspection and Appraisal Fees:** These are typically paid upfront, before closing, and are essential for ensuring the home is a sound investment.

- **Emergency Fund:** It’s crucial to have a financial cushion for unexpected home repairs or job loss, even after your down payment and closing costs.

Crafting Your Personalized Buying a House Budget Template

Now that you understand the various costs involved, it’s time to build your own personalized budget template. This isn’t a one-size-fits-all solution; it’s a dynamic tool that reflects your unique financial situation and homeownership goals. Starting with a clear picture of your income and current expenses is the foundation for a realistic and effective plan.

Begin by gathering all your financial information: pay stubs, bank statements, and current bill summaries. Understand your net monthly income after taxes and deductions. Then, list all your current monthly expenses, from rent and utilities to groceries, transportation, subscriptions, and entertainment. This comprehensive overview will show you exactly where your money is going and identify areas where you might be able to save more for your down payment and closing costs.

Once you have a handle on your current financial landscape, you can start plugging in the estimated home-buying costs. Use online calculators to get a sense of potential mortgage payments based on different home prices and interest rates. Research property taxes in your desired areas and get quotes for homeowner’s insurance. Don’t forget to factor in those hidden costs and create a contingency fund. Seeing all these numbers laid out in your buying a house budget template will reveal your true affordability.

Making sure your budget is realistic is key to avoiding stress later on. Don’t just aim for the maximum loan you’re approved for; aim for a payment that allows you to comfortably cover all your expenses, save for emergencies, and still enjoy your life. A well-thought-out budget allows you to make confident offers, knowing you can truly afford the beautiful home you’re pursuing.

Your journey to homeownership is a significant financial undertaking, but it doesn’t have to be overwhelming. By meticulously planning and tracking your finances with a detailed budget, you gain clarity and confidence in every step of the process. It helps you manage expectations, make informed decisions, and prevent common financial pitfalls.

Embrace the power of preparation, and you’ll find yourself in a much stronger position to achieve your dream home without compromising your financial well-being. This meticulous planning ensures that your new home is a source of joy and stability, rather than a burden.