Utilizing such a form offers several advantages. It streamlines the credit request process, allowing businesses to handle returns and adjustments efficiently. This efficiency reduces administrative overhead and speeds up the reimbursement or account adjustment process for customers. Furthermore, a standardized approach minimizes errors and promotes accurate record-keeping, which benefits both the buyer and the seller. A clear audit trail is created, facilitating financial reconciliation and minimizing disputes.

This article will explore the key components of a well-structured form for requesting credit, best practices for its use, and the different scenarios in which it proves invaluable.

Key Components of a Credit Note Request Form

A well-structured form ensures all necessary information is captured, facilitating efficient processing and minimizing potential disputes. The following components are essential:

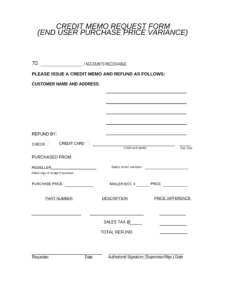

1: Unique Identifier: A distinct reference number, often pre-printed or system-generated, allows for easy tracking and retrieval of the request.

2: Date of Request: Recording the date of the request establishes a clear timeline for processing and follow-up.

3: Original Invoice Information: This includes the original invoice number, date, and total amount, linking the request directly to the relevant transaction.

4: Customer Information: Clear identification of the customer requesting the credit, including name, account number, and contact details, is crucial.

5: Reason for Credit Request: A detailed explanation of the reason for the credit request, such as returned goods, damaged items, or pricing discrepancies, is essential for proper evaluation.

6: Requested Credit Amount: The specific amount of credit being requested should be clearly stated, along with any supporting calculations or documentation.

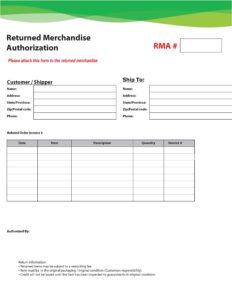

7: Supporting Documentation: Attaching relevant documentation, such as copies of the original invoice, delivery notes, or photographs of damaged goods, strengthens the request and facilitates verification.

8: Authorization Signature: A designated individual’s signature authorizes the request and ensures proper internal controls.

Accurate and complete information in these fields ensures prompt processing and minimizes the risk of errors or delays. Maintaining consistency in these components streamlines operations and strengthens financial record-keeping.

How to Create a Credit Note Request Template

Creating a standardized template ensures consistency and efficiency in handling credit note requests. A well-designed template facilitates clear communication, reduces processing time, and minimizes errors.

1: Define Required Fields: Begin by identifying the essential information needed for processing a credit note request. This typically includes a unique identifier, date of request, original invoice details, customer information, reason for the request, requested credit amount, supporting documentation, and authorization signature. Consider industry-specific requirements and internal processes.

2: Choose a Format: Select a format suitable for the business. Options include word processing documents, spreadsheets, or dedicated software solutions. The chosen format should allow for easy data entry, storage, and retrieval.

3: Design the Layout: Arrange the identified fields in a clear and logical order. Use headings and subheadings to organize information and improve readability. Ensure sufficient space for data entry and consider incorporating company branding.

4: Incorporate Instructions: Provide clear and concise instructions for completing the form. Explain the purpose of each field and specify any required formats or supporting documentation. This reduces errors and ensures consistency in submitted requests.

5: Implement Version Control: Establish a version control system to track changes and updates to the template. This ensures all users are working with the most current version and maintains a record of revisions.

6: Test and Refine: Before widespread implementation, test the template with relevant stakeholders to identify any areas for improvement. Gather feedback and refine the template based on user experience and processing efficiency.

7: Train Staff: Provide thorough training to all staff members involved in processing credit note requests. Ensure they understand how to complete the form accurately and follow established procedures.

A standardized form promotes efficient handling of credit note requests, reducing errors, and facilitating clear communication between businesses and their customers. Regular review and updates ensure the template remains aligned with evolving business needs.

Standardized forms for requesting credit notes provide a structured framework for managing returns, adjustments, and pricing discrepancies. These forms ensure clarity and completeness in communication, streamlining processing and reducing potential disputes. Key components include unique identifiers, dates, original invoice details, customer information, reasons for the request, specific amounts, supporting documentation, and authorizations. Well-designed templates incorporating these elements enable businesses to efficiently process requests, minimize errors, maintain accurate records, and foster positive customer relationships. Regular review and refinement of these templates ensure alignment with evolving business practices and regulatory requirements.

Effective management of credit note requests is crucial for maintaining accurate financial records and fostering strong business relationships. Implementing structured processes and leveraging standardized templates contributes to operational efficiency and minimizes financial discrepancies. Embracing best practices in credit note management enables organizations to maintain financial integrity and navigate complex business transactions with confidence. Continued focus on streamlined processes and clear communication ensures sustainable financial health and strengthens commercial relationships.