Utilizing such a form promotes efficiency in payment processing by minimizing confusion and potential disputes. Consistent presentation of billing information streamlines record-keeping for both businesses and their clients, simplifies reconciliation, and can contribute to improved cash flow management. Clear communication of payment terms and methods also helps build trust and professionalism in business relationships.

This foundation of understanding paves the way for a deeper exploration of specific components, creation methods, and best practices associated with generating and managing these essential documents. Subsequent sections will address these topics in detail.

Key Components

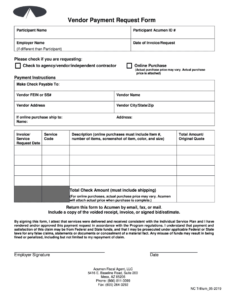

Effective documents for requesting payment share several crucial components that ensure clarity and facilitate timely processing. These elements work together to provide a comprehensive overview of the transaction and guide the payer.

1. Issuer Information: Complete business details, including legal name, address, contact information, and any relevant registration numbers (e.g., VAT ID) are essential for proper identification and record-keeping.

2. Client Information: Accurate client details, mirroring the issuer information requirements, are crucial for proper delivery and record matching.

3. Invoice Number: A unique, sequential number assigned to each document allows for easy tracking and referencing in future communications or audits.

4. Invoice Date: The date of issuance establishes the timeline for payment and is vital for accurate financial record-keeping.

5. Due Date: The date by which payment is expected, often calculated based on agreed-upon payment terms (e.g., net 30).

6. Itemized Description of Services/Goods: A clear breakdown of the provided services or goods, including quantities, unit prices, and any applicable taxes or discounts. This detailed list ensures transparency and reduces the likelihood of discrepancies.

7. Total Amount Due: The sum of all individual item costs, clearly displayed in the chosen currency. This prominent figure represents the final payment expected.

8. Payment Terms: Specified conditions surrounding the payment, such as accepted methods (e.g., bank transfer, credit card), any applicable late payment fees, or early payment discounts.

9. Payment Instructions: Clear guidance on how to remit payment, including account details for bank transfers or links to online payment portals. This simplifies the process for the payer and expedites payment receipt.

Accurate and comprehensive inclusion of these components ensures professional communication, reduces payment delays, and contributes to a smoother transaction process for all parties involved.

How to Create an Effective Document for Requesting Payment

Creating a standardized form for requesting payment involves several key steps. Careful attention to these steps ensures professionalism, clarity, and facilitates timely processing.

1. Select Appropriate Software: Utilize dedicated invoicing software, spreadsheet programs, or word processing software with templating capabilities. Software designed specifically for invoicing often offers automated features and simplifies recurring billing.

2. Input Business Information: Enter complete and accurate business details, including the legal name, address, contact information, and any relevant tax identification numbers. This information clearly identifies the issuer of the request.

3. Input Client Information: Include accurate client details, mirroring the information provided for the business. This ensures accurate delivery and proper record matching.

4. Establish a Numbering System: Implement a clear and sequential numbering system for each document. This system enables efficient tracking and referencing of past transactions.

5. Specify Dates: Clearly indicate both the invoice date and the payment due date. These dates are crucial for managing financial records and payment expectations.

6. Detail Services or Goods Provided: Provide a comprehensive, itemized list of the services rendered or goods sold. Include quantities, unit prices, and any applicable taxes or discounts.

7. Calculate the Total Amount Due: Accurately calculate and prominently display the total amount owed. This total should reflect all listed items, taxes, and discounts.

8. Outline Payment Terms: Specify accepted payment methods (e.g., bank transfer, credit card), any applicable late payment fees, or early payment discounts. Clear payment terms minimize ambiguity and potential disputes.

9. Provide Clear Payment Instructions: Include explicit instructions for remitting payment. This might include bank account details for wire transfers, links to online payment portals, or mailing addresses for checks.

A well-structured document, incorporating these elements, contributes to efficient payment processing and strengthens professional relationships. Consistent use of a standardized form simplifies record-keeping, minimizes errors, and facilitates clear communication regarding financial transactions.

Standardized documents for requesting payment are essential tools for effective financial management in any business context. From facilitating clear communication and streamlining transactions to improving record-keeping and contributing to healthy cash flow, their importance is undeniable. Understanding the key components, creation process, and best practices associated with these documents empowers businesses to operate more efficiently and maintain positive client relationships.

Leveraging these tools strategically contributes to financial stability and sustained growth. A commitment to clear, professional billing practices fosters trust and professionalism, ultimately contributing to a more robust and successful business operation. Continued refinement and adaptation of these practices to meet evolving business needs will remain a key factor in long-term success.