Utilizing such a form streamlines the process of obtaining necessary information, saving time and reducing potential misunderstandings. Access to organized historical data facilitates well-informed decisions regarding insurance coverage, underwriting, and risk management. Clear and concise data empowers stakeholders to analyze trends, identify potential liabilities, and negotiate more effectively. This ultimately leads to better risk assessment and more informed decision-making.

The following sections will delve into the specific components of these forms, best practices for their use, and various scenarios where they prove invaluable.

Key Components of a Loss Run Request Form

Effective forms for requesting loss history require specific information to ensure comprehensive data retrieval. These key elements facilitate a standardized and efficient process for gathering the necessary details.

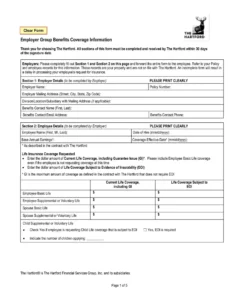

1. Contact Information: Complete contact details of the requesting party are essential for the insurer to respond effectively. This includes the requester’s name, company affiliation, address, phone number, and email address.

2. Insured Information: Accurate identification of the insured entity is crucial. This section requires the insured’s name, address, and policy number(s). Providing this information allows the insurer to pinpoint the correct policy and associated claims history.

3. Requested Period: Specifying the desired timeframe for the loss run is vital. This typically involves providing the start and end dates for the period of coverage for which the loss data is required.

4. Reason for Request: Stating the purpose of the request aids the insurer in understanding the context and tailoring the information provided. Common reasons include underwriting, renewal, mergers and acquisitions, or financing.

5. Specific Data Requirements: Some requests may require specific data points beyond the standard information. Clearly outlining these needs ensures the insurer provides all relevant details, such as claims reserves, incurred but not reported (IBNR) losses, or specific claim details.

6. Authorization: A signed authorization from the insured may be required to release the information, ensuring compliance with privacy regulations and protecting sensitive data.

Accurate and complete information within these components ensures efficient processing of requests and retrieval of comprehensive loss data. A well-structured request ultimately contributes to better risk assessment and informed decision-making.

How to Create a Loss Run Request Template

Creating a standardized template streamlines the process of requesting and obtaining loss run data. A well-designed template ensures consistency, reduces errors, and facilitates efficient communication between requesting parties and insurance providers. The following steps outline the process of creating a comprehensive and effective template.

1. Header: Begin with a clear header identifying the document as a “Loss Run Request.” Include the requesting organization’s name and contact information.

2. Insured Identification: Dedicate a section to clearly identify the insured. Include fields for the insured’s name, address, policy number(s), and any other relevant identifying information.

3. Request Timeframe: Designate fields to specify the desired period for the loss run data. Include start and end dates for the requested period of coverage.

4. Purpose of Request: Include a section to specify the reason for the request. Providing context helps the insurer tailor the data provided. Options might include renewal, underwriting, mergers and acquisitions, financing, or other specific needs.

5. Data Requirements: Outline specific data points required. This may include incurred losses, paid losses, claim reserves, IBNR losses, claim details, and any other relevant metrics. Checkboxes or lists can facilitate clear communication of specific requirements.

6. Authorization Section: Include a designated space for the insured’s signature to authorize the release of the requested information. This ensures compliance with privacy regulations and secures sensitive data.

7. Contact Information for the Insurer: Provide space for the insurer’s contact information, including the name of the contact person, address, phone number, and email address. This facilitates direct communication and efficient processing of the request.

8. Instructions and Clarifications: Include clear and concise instructions to ensure the request is understood and processed correctly. This may include guidance on preferred submission methods, required formats, and expected turnaround times.

A well-designed template ensures clarity, accuracy, and efficiency in the loss run request process. Consistent use of a standardized template facilitates effective communication and improves the overall risk assessment process.

Effective risk management relies on accurate and comprehensive data. Standardized forms for requesting loss history provide a crucial framework for obtaining this essential information. Understanding the key components of these forms, such as insured identification, requested timeframe, and specific data requirements, ensures the efficient retrieval of relevant data. Developing and utilizing a well-structured template streamlines the request process, promoting clear communication between requesting parties and insurance providers. This ultimately facilitates better informed underwriting decisions, more accurate risk assessments, and improved overall risk management strategies.

Leveraging organized and readily available historical data empowers stakeholders to make informed decisions based on concrete evidence. As the insurance landscape continues to evolve, the importance of efficient and accurate data retrieval will only grow. Embracing standardized processes and utilizing comprehensive templates for requesting loss runs is a crucial step toward effective risk management and informed decision-making in the face of evolving challenges.