Running a small business is an exciting journey, but it often comes with its fair share of financial puzzles. One moment you’re celebrating a big sale, the next you’re wondering where all your cash went. Keeping a firm grip on your finances is not just good practice; it’s essential for survival and growth, especially when every penny counts.

That’s where a reliable small business weekly budget template truly shines. It transforms the overwhelming task of money management into a clear, actionable plan. Instead of looking at your finances once a month and feeling surprised, a weekly budget allows you to see the ebb and flow of your cash in real time, giving you the power to make quick, informed decisions.

This article will guide you through the ins and outs of creating and utilizing a weekly budget that works for your unique business. We’ll explore why this granular approach can be a game-changer, what key elements to include, and how to put it into practice to foster consistent financial health.

Why a Weekly Budget is Your Business’s Best Friend

Most businesses operate on monthly or even quarterly budget cycles, and while those are important for long-term strategic planning, they can sometimes feel too distant for the day-to-day realities of a small operation. A weekly budget, however, brings your financial focus right into the present. It helps you catch potential issues before they spiral, identify opportunities for savings, and allocate resources more effectively where they’re needed most, week in and week out.

Think of it like navigating a ship. A monthly budget is your overall course plotting for the entire ocean journey. A weekly budget, on the other hand, is like having a keen eye on the current weather patterns and immediate obstacles, allowing you to adjust your sails and rudder with precision. This level of agility is invaluable for small businesses that often face fluctuating income and unexpected expenses.

By breaking down your financial goals and obligations into smaller, manageable weekly chunks, you gain immense clarity. It becomes easier to see exactly where your money is coming from and where it’s going. This visibility empowers you to make proactive decisions, rather than reactive ones, which is a common pitfall for many growing enterprises.

Breaking Down Your Weekly Finances

Understanding where your money originates and its ultimate destination is the very cornerstone of an effective budget. For a weekly template, we’re particularly interested in those recurring, short-term financial movements that define your week-to-week operations. Let’s delve into the typical components you’ll want to track.

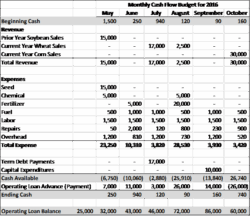

Your weekly income might include direct sales from products or services rendered, payments received for invoices that were due within that specific week, or even a regular stream of subscription revenues if your business model supports it. It’s crucial to estimate these as accurately as possible, perhaps by looking at historical data or anticipated client work.

Essential Weekly Expenses to Track

- Payroll for staff paid on a weekly basis

- Payments to suppliers for goods or services crucial to the week’s operations

- Utilities, if billed weekly, or a calculated weekly portion of larger bills

- Small marketing expenditures, such as social media ad boosts or local flyers

- Fuel, transportation costs, or delivery fees

- Minor office supplies or operational consumables

- A small buffer for miscellaneous, unexpected costs that often pop up

Categorizing these elements meticulously allows you to gain an unparalleled level of insight into your business’s financial pulse. It helps you identify spending patterns, areas where you might be over budget, and potential opportunities to reallocate funds for better strategic advantage.

Building Your Weekly Budget Template: Step-by-Step

Creating your very own small business weekly budget template doesn’t have to be an intimidating ordeal. In fact, it’s about establishing a straightforward, repeatable system that you can effortlessly integrate into your routine. The goal is to make financial tracking a habit, not a chore.

Start by dedicating a specific time each week, perhaps Friday afternoon or Monday morning, to sit down with your numbers. First, you’ll want to project all your anticipated income for the upcoming seven days. This means looking at your sales forecasts, outstanding invoices expected to clear, and any other cash inflows. Once you have a clear picture of what’s coming in, you then turn your attention to what’s going out.

This process is about gaining control and making your money work harder for you. By consistently following these steps, you’ll build a robust framework that supports sustainable growth and gives you peace of mind.

Simple Steps to Get Started

- Step 1: Project Your Weekly Income. Compile all expected revenues for the week. This could be based on average weekly sales, booked appointments, or scheduled client payments. Be realistic and a little conservative.

- Step 2: List Your Fixed Weekly Expenses. Identify costs that are largely consistent each week. Think of recurring software subscriptions, a fixed portion of your rent or utilities, or weekly payroll for certain staff members.

- Step 3: Account for Variable Weekly Expenses. These are the expenses that can fluctuate. Examples include raw materials depending on production, marketing ad spend that varies, or travel costs. It’s smart to allocate a small contingency fund here for the unexpected.

- Step 4: Calculate Your Net Position. Subtract your total projected expenses from your total projected income. This will show you if you’re forecasting a surplus or a deficit for the week.

- Step 5: Review and Adjust Regularly. At the end of each week, compare your budgeted figures with your actual income and expenses. What went as planned? What surprised you? Use these insights to refine your estimates and make smarter spending decisions for the following week. This iterative feedback loop is crucial for improvement.

Embracing a weekly budgeting cycle empowers you with unprecedented clarity and control over your business’s financial health. It allows you to swiftly adapt to market changes, capitalize on opportunities, and proactively address potential challenges before they escalate. This consistent oversight is a powerful tool for fostering resilience and ensuring steady progress towards your long-term goals.

By making this commitment to regular financial review, you’re not just managing money; you’re actively building a stronger, more stable foundation for your small business. The peace of mind that comes from knowing exactly where your business stands financially, day by day and week by week, is truly invaluable for any entrepreneur.