Utilizing a pre-designed structure offers several advantages. It reduces the time and effort required to collect essential financial data, minimizes the risk of overlooking critical information, and promotes objectivity in credit evaluations. This systematic approach also allows for easier comparison across different applicants or clients and contributes to a more efficient and reliable credit approval process. Improved risk management and reduced potential for financial losses are key outcomes of this organized method.

This foundation of understanding facilitates exploration of specific components within these forms, the legal considerations involved, and best practices for their implementation. Furthermore, analyzing variations across different industries and regions provides valuable insights into the nuanced applications of this essential credit management tool.

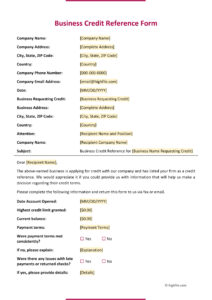

Key Components of a Credit Reference Request

Effective credit evaluations rely on comprehensive information. A well-structured request ensures consistent data collection and facilitates informed decision-making. The following components are typically included:

1. Applicant Information: This section identifies the individual or business seeking credit. Essential details include legal name, address, contact information, and business registration details (if applicable).

2. Reference Request Details: This section specifies the purpose of the request, the credit amount being considered, and the type of credit facility. Clarity here ensures the reference provider understands the context of the request.

3. Reference Provider Information: This section identifies the financial institution or trade reference being contacted. Accurate contact details, including name, address, phone number, and email address, are essential for efficient communication.

4. Specific Questions for the Reference: This section contains targeted questions about the applicant’s financial history and creditworthiness. Inquiries typically focus on credit limit, payment history, outstanding balances, and overall credit experience.

5. Authorization and Consent: This section includes a declaration from the applicant authorizing the release of credit information to the requesting party. This ensures compliance with data privacy regulations.

6. Contact Information for the Requesting Party: This section provides the contact details of the individual or organization requesting the credit reference. This allows the reference provider to clarify any questions or provide additional information.

7. Date: Clearly indicating the date of the request helps track responses and ensures information is current.

A comprehensive request form incorporating these elements facilitates a thorough credit assessment, contributing to responsible lending practices and informed business decisions.

How to Create a Credit Reference Request Template

Developing a standardized credit reference request template promotes consistency and efficiency in credit assessments. A well-structured template ensures all necessary information is gathered, facilitating informed decision-making.

1. Define the Purpose: Clearly establish the objective of the request. Specify the type of credit being sought and the information required to make a sound credit decision.

2. Gather Essential Information Fields: Include fields for applicant details (name, address, business information), reference provider details (name, contact information), and specific questions regarding credit history, payment patterns, and outstanding balances.

3. Structure the Template Logically: Organize information in a clear, sequential manner. Group related fields together to enhance readability and facilitate efficient completion.

4. Incorporate Authorization and Consent: Include a section for the applicant to authorize the release of credit information. This ensures compliance with data privacy regulations and maintains ethical practices.

5. Ensure Clarity and Conciseness: Use clear, unambiguous language. Avoid jargon or overly complex terminology. Keep questions concise and focused on relevant information.

6. Review and Refine: Before implementation, thoroughly review the template for completeness and accuracy. Solicit feedback from relevant stakeholders to ensure its effectiveness and practicality.

7. Implement and Maintain: Once finalized, implement the template consistently across all credit applications. Regularly review and update the template to reflect evolving business needs and regulatory requirements.

A well-designed template provides a framework for consistent data collection, enabling objective credit evaluations and informed business decisions. This standardized approach strengthens risk management and contributes to sound financial practices. Regular review and refinement ensure the template remains relevant and effective in a dynamic business environment.

Standardized credit reference request templates provide a crucial framework for gathering consistent and comprehensive financial information. These structured forms streamline the credit assessment process, enabling informed decision-making and mitigating potential risks. By ensuring the collection of essential data points, such as payment history, credit limits, and overall financial standing, these templates contribute to more objective and reliable credit evaluations. The systematic approach facilitates efficient comparisons across applicants, contributing to sounder financial practices and reducing the likelihood of financial losses.

Implementing and maintaining well-designed templates represents a commitment to responsible lending and robust risk management. Regular review and refinement of these templates are essential to adapt to evolving business needs and regulatory landscapes. Ultimately, the effective utilization of credit reference request templates strengthens financial stability and promotes sustainable business growth.